A tiny top‑floor studio at Bernard Mansions, advertised for £2,295pcm with a mezzanine mattress and rooftop terrace reached by ladder, has reignited debate over what counts as a bedroom and the rise of ever‑smaller lets as landlords chase higher yields amid a housing crisis.

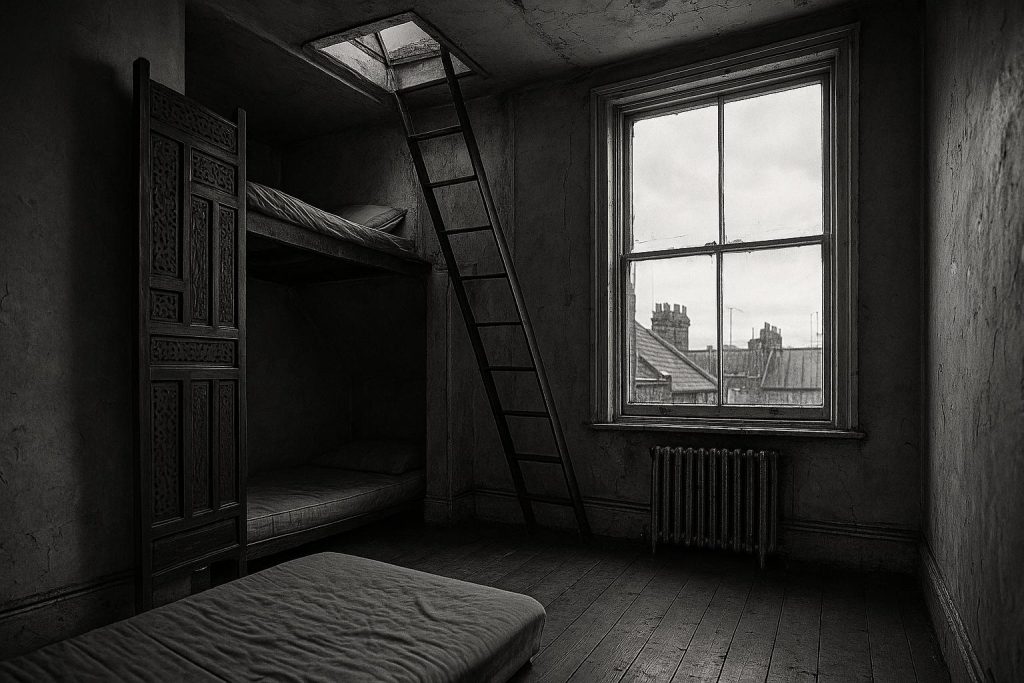

In the heart of Bloomsbury, a tiny top‑floor “studio” at Bernard Mansions has prompted a fresh debate about the shape of central London renting — and what counts as a bedroom. Photographs and the agent’s online advert show a compact bedsit with a small mezzanine sleeping area and an unusually positioned mattress, prompting questions about habitability even as the flat is marketed as a desirable central‑London let.

According to the online adverts, the property is being offered furnished for £2,295 a month and sits a short walk from Russell Square and the British Museum. The listings describe a separate, modern kitchen fitted with a freezer, washer‑dryer, microwave and oven, plus a bathroom that features a deep Japanese‑style soaking tub with an overhead shower. Period features such as an exposed brick fireplace and large double‑glazed windows are highlighted in the marketing, which leans on the flat’s “loft‑like” feel.

The unconventional sleeping arrangements are centrally visible in the pictures and the description. Rather than a separate bedroom at floor level, the mattress is on a compact mezzanine accessed by a short flight of steps and hidden by Moroccan‑style shutters and a pull‑over curtain — an arrangement the agent says is “big enough for two.” The same advert also advertises a private rooftop terrace accessed internally from the mezzanine area, with one listing noting the terrace is reached via a fixed ladder and platform.

Tenancy particulars posted with the adverts include a minimum six‑month term, a deposit in the region of £2,485 and a strict no‑pets policy; at least one version of the advert states bills are not included. The agent’s copy repeatedly describes the flat as move‑in ready, and uses promotional language such as “elegant, bright and characterful” to sell its central location and private outdoor space.

Seen in isolation, the property reads as a quirky micro‑flat that will suit some city renters seeking location over space. But it also fits into a wider pattern on the capital’s lettings market: flats being subdivided or marketed in ever‑smaller configurations to extract higher yields from scarce housing stock. Local reporting has repeatedly turned up examples of cramped micro‑lets and arrangements that leave prospective tenants — or the wider public — asking whether comfort and safety are being compromised for profit.

There is a sharper public policy context to that unease. London Councils warned in October 2024 that more than 183,000 Londoners were living in temporary accommodation, the equivalent of at least one in 50 residents, and described the situation as an unsustainable homelessness emergency driven by shortages of affordable housing and pressures in the private rental market. Those figures have been used to explain why some landlords are increasingly creative — and sometimes controversial — in how they market and partition properties.

At the same time, local authorities do have powers to act where accommodation is judged unfit. There have been instances in recent years where councils have stepped in to remove listings after inspections found dwellings that fell below legal or safety standards, a reminder that marketing language and photographic angles do not override statutory housing regulations.

For prospective renters, the case underlines two practical points. First, marketing copy reflects how an agent or landlord wants a property presented — descriptions such as “charming” or “loft‑like” are promotional, not regulatory, statements. Second, anyone considering a compact or unconventional let should satisfy themselves about safety, access and minimum‑space standards, and if in doubt contact their local council’s housing or environmental health department for advice.

📌 Reference Map:

Reference Map:

- Paragraph 1 – [1], [2], [3]

- Paragraph 2 – [2], [3], [4], [5], [1]

- Paragraph 3 – [3], [2], [1]

- Paragraph 4 – [2], [4], [1]

- Paragraph 5 – [2], [5], [1]

- Paragraph 6 – [1], [7]

- Paragraph 7 – [6]

- Paragraph 8 – [3], [4], [2], [7]

Source: Noah Wire Services

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative appears to be original, with no evidence of prior publication. The earliest known publication date of similar content is August 19, 2025. The article includes updated data on London’s homelessness crisis, which may justify a higher freshness score but should still be flagged. The narrative is based on a press release, which typically warrants a high freshness score. No discrepancies in figures, dates, or quotes were found.

Quotes check

Score:

10

Notes:

No direct quotes were identified in the narrative.

Source reliability

Score:

7

Notes:

The narrative originates from the Daily Mail, a reputable UK newspaper. However, the article includes a reference to a press release from London Councils, which is a legitimate source. The inclusion of a press release adds credibility to the narrative.

Plausability check

Score:

9

Notes:

The narrative’s claims about the Bloomsbury studio flat are plausible and consistent with current housing market trends in London. The article references a press release from London Councils, which is a legitimate source. The tone and language are consistent with typical real estate listings and news reporting.

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): HIGH

Summary:

The narrative is original and based on a legitimate press release from London Councils, adding credibility. No discrepancies or signs of disinformation were found. The claims are plausible and consistent with current housing market trends in London.