Listen to the article

Key Takeaways

Playback Speed

Select a Voice

Tech Giants Fuel Nuclear Renaissance Amid Uranium Supply Crunch

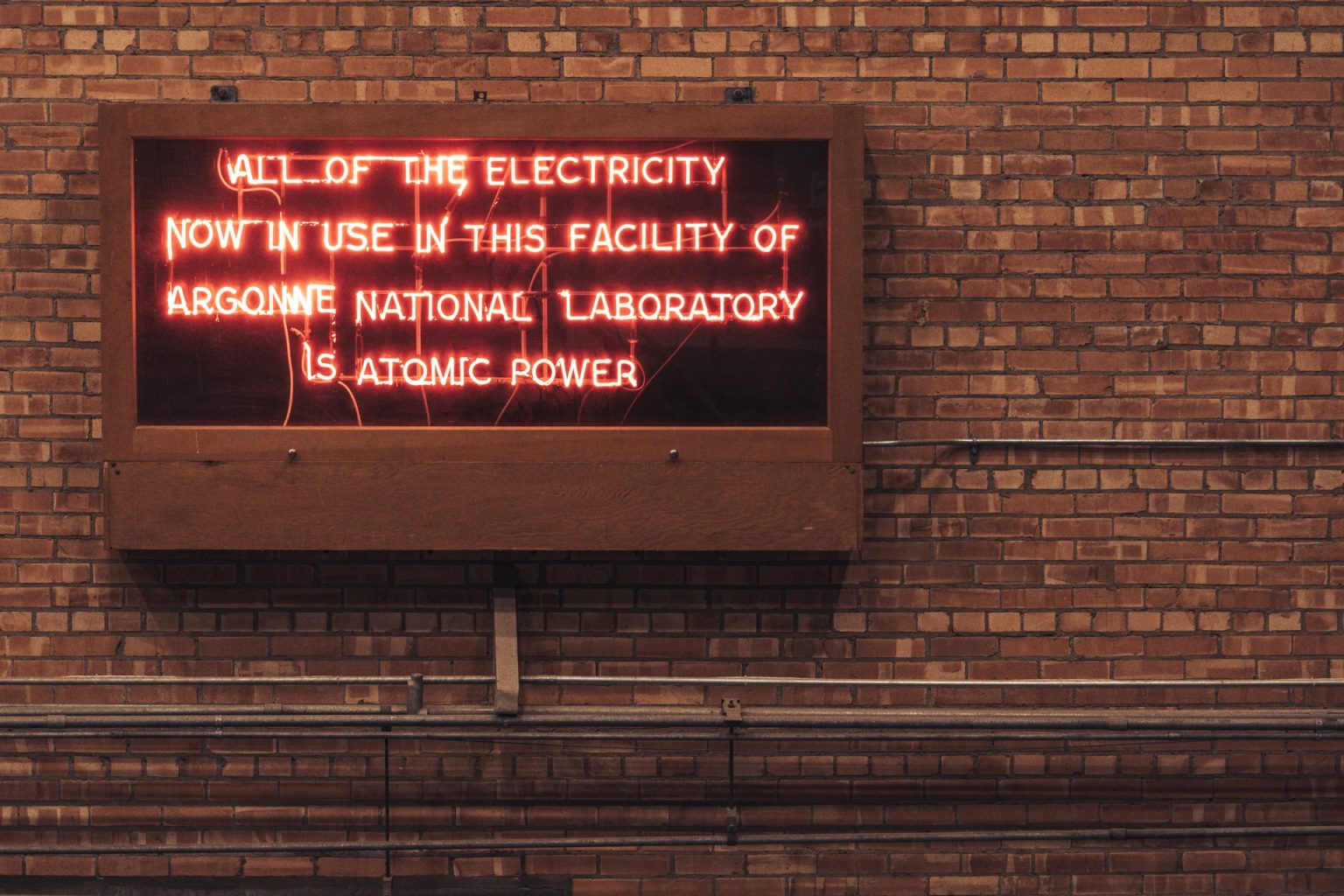

A fundamental shift is reshaping the global uranium market as major technology companies pour billions into nuclear energy infrastructure to power artificial intelligence data centers. This unprecedented corporate-driven demand, combined with persistent supply constraints and heightened geopolitical tensions, has created what industry experts describe as the most favorable market conditions in over a decade.

Unlike previous uranium

Subscribe to Continue Reading

Get unlimited access to all premium content

Tech Giants Fuel Nuclear Renaissance Amid Uranium Supply Crunch

A fundamental shift is reshaping the global uranium market as major technology companies pour billions into nuclear energy infrastructure to power artificial intelligence data centers. This unprecedented corporate-driven demand, combined with persistent supply constraints and heightened geopolitical tensions, has created what industry experts describe as the most favorable market conditions in over a decade.

Unlike previous uranium cycles driven primarily by utility procurement, today’s demand surge stems from tech giants making strategic, long-term commitments to nuclear power. Microsoft’s recent decision to join the World Nuclear Association signals this shift, while Amazon has committed $500 million to small modular reactor development alongside comprehensive nuclear supply agreements. Meta has similarly positioned itself in the nuclear space.

“Whoever wins the race to have more scalable green energy has a better chance of winning the AI wars,” explains Dev Randhawa, CEO of F3 Uranium. The energy requirements for AI data centers are substantial, requiring reliable, 24/7 power that only nuclear can provide at scale without carbon emissions.

This tech-driven demand represents a fundamental departure from historical patterns, creating sustained consumption rather than cyclical purchasing. One small modular reactor can power either 700,000 homes or a single data center, highlighting the immense energy density requirements of artificial intelligence infrastructure.

Meanwhile, global uranium supply faces persistent constraints that show no signs of easing. Established producers consistently struggle to meet production targets, with both Kazakhstan’s Kazatomprom and Canada’s Cameco recently announcing production shortfalls.

“It’s a bit like taking a used car out of storage,” explains David Cates, CEO of Denison Mines, describing the challenges of restarting uranium operations. “When you do get it back to life, it’s still a car that’s been driven for whatever kilometers it was.”

These operational challenges span multiple jurisdictions and extraction methods. Kazakhstan grapples with sulfuric acid cost inflation for its in-situ recovery operations, while Paladin has encountered algae issues in Namibia. These difficulties suggest systemic rather than isolated operational challenges across the industry.

The supply picture becomes more concerning when considering the limited pipeline of new projects. “It takes 10 years minimum by the time you explore and develop a project, and probably more like 15 or 20 years,” notes Philip Williams, CEO of IsoEnergy. This extended development horizon means current supply constraints will persist even with immediate investment in new projects.

For the United States, the uranium supply challenge represents a strategic vulnerability. The country consumes approximately 50 million pounds of uranium annually while producing only 4-5 million pounds domestically, creating a critical dependence on foreign suppliers during a period of heightened geopolitical tensions.

In response, the U.S. government has designated uranium as a critical mineral and implemented Defense Production Act provisions favoring domestic development. The Development Finance Corporation now provides project funding for uranium developments that align with national security objectives, while strategic reserve programs create additional demand beyond utility requirements.

“Since the Trump administration has come in, there’s been a complete change of attitude in the United States,” reports Stephen Roman, CEO of Global Atomic. “The administration right up to Secretary of State Marco Rubio knows about our project. This has been basically blessed by the White House, the State Department and various others in the administration.”

Despite these policy supports, even aggressive domestic production scenarios cannot eliminate America’s import dependence. This structural deficit ensures continued reliance on allied suppliers, particularly Canada’s Athabasca Basin, creating investment opportunities for companies with advanced projects in stable jurisdictions.

Institutional analysts are projecting significant price increases for uranium, with Citibank forecasting prices above $100 by year-end compared to current spot prices around $70. This price appreciation potential reflects the fundamental supply-demand imbalance rather than speculative positioning.

The sector has also developed more sophisticated financing structures that address traditional mining investment concerns, particularly the dilution risk associated with capital-intensive development projects. Companies approaching production stand to benefit significantly from uncommitted or market-exposed production during supply shortages.

For investors looking to capitalize on these dynamics, experts recommend focusing on companies with proven management teams, advanced projects in established jurisdictions like Canada’s Athabasca Basin or Wyoming’s uranium districts, and strong balance sheets that can execute development plans without dilutive financing pressure.

As electricity demand continues to grow from data centers and broader electrification initiatives, nuclear power’s role becomes increasingly vital. “Clearly the forecast for electricity demand is driving the need to find every kind of energy source and nuclear’s in the frame,” notes Bruce Lane of American Uranium.

The convergence of tech-driven demand, persistent supply constraints, and supportive government policies has created a compelling investment case for uranium that extends beyond traditional commodity cycles, positioning the sector for potential sustained growth through this decade and beyond.

13 Comments

The tech sector’s involvement in nuclear energy is exciting. It could lead to faster innovation and more efficient energy solutions.

The tech sector’s involvement in nuclear energy is exciting. It could lead to faster innovation and more efficient energy solutions.

The tech sector’s involvement in nuclear energy is exciting. It could lead to faster innovation and more efficient energy solutions.

The tech sector’s involvement in nuclear energy is exciting. It could lead to faster innovation and more efficient energy solutions.

The tech sector’s involvement in nuclear energy is exciting. It could lead to faster innovation and more efficient energy solutions.

The tech sector’s involvement in nuclear energy is exciting. It could lead to faster innovation and more efficient energy solutions.

The tech sector’s involvement in nuclear energy is exciting. It could lead to faster innovation and more efficient energy solutions.

The tech sector’s involvement in nuclear energy is exciting. It could lead to faster innovation and more efficient energy solutions.

The tech sector’s involvement in nuclear energy is exciting. It could lead to faster innovation and more efficient energy solutions.

The tech sector’s involvement in nuclear energy is exciting. It could lead to faster innovation and more efficient energy solutions.

The tech sector’s involvement in nuclear energy is exciting. It could lead to faster innovation and more efficient energy solutions.

The tech sector’s involvement in nuclear energy is exciting. It could lead to faster innovation and more efficient energy solutions.

The tech sector’s involvement in nuclear energy is exciting. It could lead to faster innovation and more efficient energy solutions.