TDG Gold Accelerates Exploration with Second Drill Rig at Greater Shasta-Newberry Project

TDG Gold Corp. has mobilized a second drill rig to its wholly-owned Greater Shasta-Newberry (GSN) exploration project in northern British Columbia’s Toodoggone District. The additional rig is part of an accelerated, fully funded exploration program targeting potential copper-gold-silver mineralization as the company advances its 2025 Phase I drilling campaign.

The GSN project has gained strategic impo

...

TDG Gold Accelerates Exploration with Second Drill Rig at Greater Shasta-Newberry Project

TDG Gold Corp. has mobilized a second drill rig to its wholly-owned Greater Shasta-Newberry (GSN) exploration project in northern British Columbia’s Toodoggone District. The additional rig is part of an accelerated, fully funded exploration program targeting potential copper-gold-silver mineralization as the company advances its 2025 Phase I drilling campaign.

The GSN project has gained strategic importance due to its location adjacent to the AuRORA1 discovery, a significant copper-gold porphyry system announced in 2024 by mining giants Freeport McMoRan Inc. and Amarc Resources Ltd. While TDG has no ownership stake in AuRORA1 or related properties, the proximity has influenced its exploration strategy, particularly around the AuWEST target area which lies directly west of the Freeport-Amarc discovery.

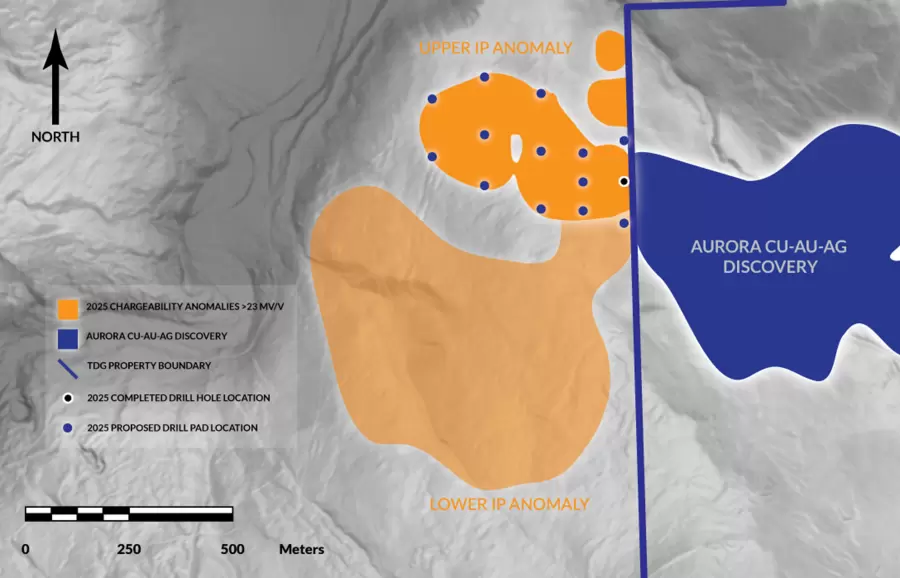

The newly deployed second drill rig will focus on rapidly testing exploration targets identified through integrated analysis of geophysical, geochemical, and geological data, including results from ongoing Induced Polarization (IP) surveys. According to company officials, these targets were prioritized by overlaying multiple datasets including IP responses, alteration mapping, structural data, and regional magnetic anomalies.

Both drill rigs are now operating in the AuWEST area, with the second rig scheduled to begin operations by week’s end. TDG indicates that drilling locations will remain flexible, guided by ongoing interpretations of geological and geophysical findings.

In the current program, TDG has already completed one near-vertical drill hole reaching a depth of 645 metres. This initial hole was designed to determine whether mineralization related to the AuRORA1 system extends onto TDG’s property. It also targeted a gold-in-soil geochemical anomaly coinciding with IP anomalies in the same area. Core samples have been sent for expedited assay analysis, with results to be released following comprehensive evaluation.

The 2025 Phase I exploration program is supported by extensive geophysical data from ongoing IP surveys as well as previous airborne and ground magnetic surveys. This data has outlined both upper and lower anomalies, some sharing characteristics with the neighboring AuRORA1 discovery. The upper anomaly has drawn particular interest as it occurs at a similar elevation to AuRORA1.

Drill spacing has been planned at approximately 100-metre intervals to help delineate the scale and continuity of any mineralization, though the company notes this could be adjusted based on findings from early drilling.

TDG Gold has established itself as a significant player in the Toodoggone District, controlling approximately 50,000 hectares of both brownfield and greenfield terrain. The GSN project, covering roughly 5.5 square kilometres, was first identified as a major exploration target in January 2023, gaining additional interest following the AuRORA1 discovery announcement in early 2025.

In 2024, TDG expanded its regional footprint by identifying new copper-gold targets across the “Baker Complex,” a 53-square-kilometre area that includes the North Quartz and Trident targets. Beyond GSN, TDG’s Toodoggone portfolio includes several historical mining operations such as the Shasta and Baker mines, which produced intermittently between 1981 and 2012 and have generated more than 65,000 metres of historical drilling data.

The company updated the mineral resource estimate for Shasta in 2025, noting the deposit remains open at depth and along strike, suggesting potential for resource expansion.

TDG has also recently diversified its asset base beyond the Toodoggone. In July 2025, the company completed the acquisition of Anyox Copper Ltd., adding over 10,000 hectares of mineral tenure on British Columbia’s Anyox Peninsula in the southern Golden Triangle region. This acquisition includes the former producing Hidden Creek copper-gold mine and provides access to a volcanogenic massive sulphide system with multi-metal potential including copper, gold, lead, zinc, and silver.

Exploration at Anyox is expected to commence in the second half of 2025. Despite its historical significance and past production, the area has seen limited modern exploration techniques applied, potentially offering TDG opportunities for new discoveries using contemporary methods.

Trading on the TSX Venture Exchange under the symbol TDG and on the OTCQX as TDGGF, the company’s aggressive exploration approach comes amid strong global demand for copper, increasingly viewed as essential for the global energy transition.

48 Comments

Uranium names keep pushing higher—supply still tight into 2026.

Silver leverage is strong here; beta cuts both ways though.

Good point. Watching costs and grades like a hawk this year.

Silver leverage is strong here; beta cuts both ways though.

Silver leverage is strong here; beta cuts both ways though.

Good point. Watching costs and grades like a hawk this year.

Management hinted at expansion capex; cash flow coverage will matter if prices soften.

Good point. Watching costs and grades like a hawk this year.

Production mix shifting toward Markets might help margins if metals stay firm.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Management hinted at expansion capex; cash flow coverage will matter if prices soften.

Production mix shifting toward Markets might help margins if metals stay firm.

Interesting update on TDG Gold (TSXV:TGD) Mobilizes Additional Drill Rig at Greater Shasta-Newberry Project in Northern British Columbia. Curious how the grades will trend next quarter.

Good point. Watching costs and grades like a hawk this year.

Management hinted at expansion capex; cash flow coverage will matter if prices soften.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Production mix shifting toward Markets might help margins if metals stay firm.

Good point. Watching costs and grades like a hawk this year.

Interesting update on TDG Gold (TSXV:TGD) Mobilizes Additional Drill Rig at Greater Shasta-Newberry Project in Northern British Columbia. Curious how the grades will trend next quarter.

Good point. Watching costs and grades like a hawk this year.

Production mix shifting toward Markets might help margins if metals stay firm.

Good point. Watching costs and grades like a hawk this year.

If AISC keeps dropping, this becomes investable for me.

I like the balance sheet here—less leverage than peers.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Silver leverage is strong here; beta cuts both ways though.

Nice to see insider buying—usually a good signal in this space.

Silver leverage is strong here; beta cuts both ways though.

Good point. Watching costs and grades like a hawk this year.

Uranium names keep pushing higher—supply still tight into 2026.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Production mix shifting toward Markets might help margins if metals stay firm.

Good point. Watching costs and grades like a hawk this year.

Nice to see insider buying—usually a good signal in this space.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Nice to see insider buying—usually a good signal in this space.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Interesting update on TDG Gold (TSXV:TGD) Mobilizes Additional Drill Rig at Greater Shasta-Newberry Project in Northern British Columbia. Curious how the grades will trend next quarter.

Management hinted at expansion capex; cash flow coverage will matter if prices soften.

Good point. Watching costs and grades like a hawk this year.

Exploration results look promising, but permitting will be the key risk.

Good point. Watching costs and grades like a hawk this year.