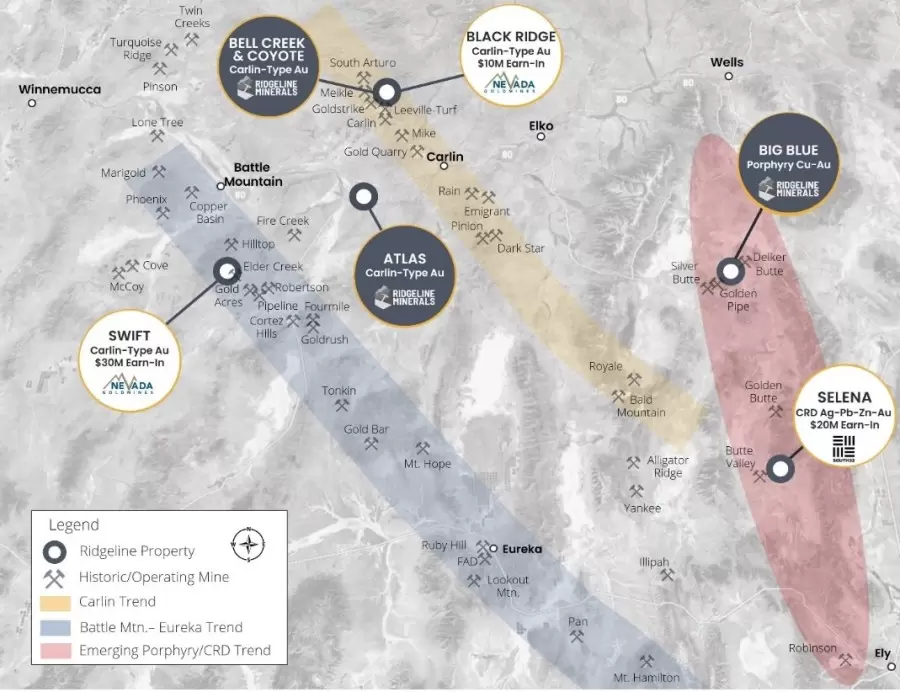

Nevada’s Ridgeline Minerals reports significant progress on its exploration activities across three key projects in north-central Nevada. The company is advancing these sites through strategic partnerships with industry heavyweights Nevada Gold Mines (NGM) and South32 Limited, with operations supported by a record US $9.5 million partner-funded exploration budget for 2025.

Ridgeline President and CEO Chad Peters highlighted the smooth progression of drilling operations at the Swift, Black

...

Nevada’s Ridgeline Minerals reports significant progress on its exploration activities across three key projects in north-central Nevada. The company is advancing these sites through strategic partnerships with industry heavyweights Nevada Gold Mines (NGM) and South32 Limited, with operations supported by a record US $9.5 million partner-funded exploration budget for 2025.

Ridgeline President and CEO Chad Peters highlighted the smooth progression of drilling operations at the Swift, Black Ridge, and Selena projects, with results expected to be released throughout late 2025 and early 2026. “We expect drilling to continue at Swift and Selena through the end of 2025 with steady news flow and assay results throughout the end of the year,” Peters noted in a company statement.

At the Selena project in White Pine County, Ridgeline is operating under an earn-in agreement with South32 Limited that could see up to US $20 million in expenditures. Drilling began in June with the first core tail initiated in late July. The current program includes plans for up to three deep core holes totaling 4,500 meters, backed by a US $3.45 million budget. These efforts target a highly conductive Magnetotellurics (MT) anomaly at the Chinchilla Sulfide carbonate replacement deposit (CRD) target.

South32 has reported US $573,758 in qualifying expenditures through June 30, 2025, working toward the US $10 million minimum required by August 2029 to secure an initial 60% interest in the property.

Meanwhile, the Swift gold project in Lander County is being operated by Nevada Gold Mines under a US $30 million earn-in agreement. NGM has already invested substantially in the property, reporting US $10.87 million in qualifying expenditures as of mid-2025. To earn a 60% interest, NGM must reach US $20 million in expenditures by the end of 2026.

Current drilling at Swift targets the projected strike of a previously reported high-grade gold intercept of 1.1 meters grading 10.4 g/t gold. The geological focus is on areas where cross-cutting fault zones intersect a modeled fold hinge in the hanging wall of the Mill Creek thrust fault—a structural configuration that potentially serves as a trap for mineralized fluids.

At the Black Ridge project, also in Lander County, NGM completed a deep core hole in August 2025 targeting lower-plate carbonate host rocks. This geological sequence is significant as it has been associated with numerous productive gold deposits along the northern Carlin Trend. NGM has spent US $586,904 toward the US $4.5 million required by July 2028 to earn a 60% interest in this property.

This drill hole represents the first major test of the target at Black Ridge, with assay results expected in the fourth quarter of 2025. The company has noted that while the project is on-trend with NGM’s Leeville Mine and Fallon Deposit to the south, mineralization at these nearby properties may not necessarily indicate similar findings at Black Ridge.

The surge in exploration activity comes amid continued interest in Nevada’s gold potential. The state remains the United States’ primary gold producer and one of the world’s most prolific mining jurisdictions, accounting for approximately 75% of U.S. gold production.

Ridgeline Minerals, headquartered in Vancouver, British Columbia, manages approximately 200 square kilometers of exploration properties in Nevada. The company employs a hybrid business model that combines wholly owned assets with strategic partnerships through earn-in agreements. These partnerships collectively represent potential partner-funded expenditures of up to US $60 million.

As drilling continues across all three projects, the mining sector will be watching closely for results that could further define the mineral potential of Ridgeline’s Nevada portfolio. The company has committed to publicly disclosing all findings following internal review and verification, in accordance with industry regulatory standards.