Pan Global Resources Advances Spanish Mining Projects Toward Resource Definition and New Discoveries

Pan Global Resources (TSXV:PGZ) has announced significant progress in its exploration and drilling programs at two key projects in Spain, positioning the company for potential growth in its copper and polymetallic resources portfolio. The company is simultaneously advancing toward a maiden resource estimate at its flagship property while pursuing new discoveries at multiple promising targets.

Acc

...

Pan Global Resources Advances Spanish Mining Projects Toward Resource Definition and New Discoveries

Pan Global Resources (TSXV:PGZ) has announced significant progress in its exploration and drilling programs at two key projects in Spain, positioning the company for potential growth in its copper and polymetallic resources portfolio. The company is simultaneously advancing toward a maiden resource estimate at its flagship property while pursuing new discoveries at multiple promising targets.

According to a recent update, the company is in the final stages of selecting a consultant to produce a National Instrument 43-101-compliant Technical Report for the La Romana copper-tin-silver deposit at its Escacena Project in southern Spain. This report will include the company’s first formal Mineral Resource Estimate, expected before year-end.

Tim Moody, Pan Global’s President and CEO, expressed optimism about the company’s 2025 drill programs. “We are testing a compelling suite of high-priority targets, highlighting excellent potential for additional new discoveries of significant mineralization,” Moody stated. “Simultaneously, the team is advancing the plans for the La Romana copper-tin-silver deposit’s maiden Resource.”

The Escacena Project represents a substantial land package of 5,760 hectares fully controlled by Pan Global in the eastern portion of the Iberian Pyrite Belt, one of Europe’s most prolific mining regions. The strategic location places the project within 40 kilometers of three active mining operations and associated processing infrastructure, including the operational Riotinto mine and bordering the former Aznalcóllar and Los Frailes mines.

This prime location could provide significant logistical advantages as the company moves toward potential development. Notably, the adjacent Los Frailes property is in the final permitting stage for redevelopment by Minera Los Frailes, a subsidiary of Grupo México, signaling continued mining interest in the immediate area.

Beyond La Romana, Pan Global has identified multiple mineralized targets within the Escacena Project, including the La Pantoja copper-tin-silver zone and the Cañada Honda copper-gold occurrence. Additional exploration targets including Bravo, Barbacena, El Pozo, Romana Norte, San Pablo, Zarcita, Hornitos, La Jarosa, Romana Deep, and Cortijo remain at earlier stages of investigation but highlight the project’s potential to host multiple deposits.

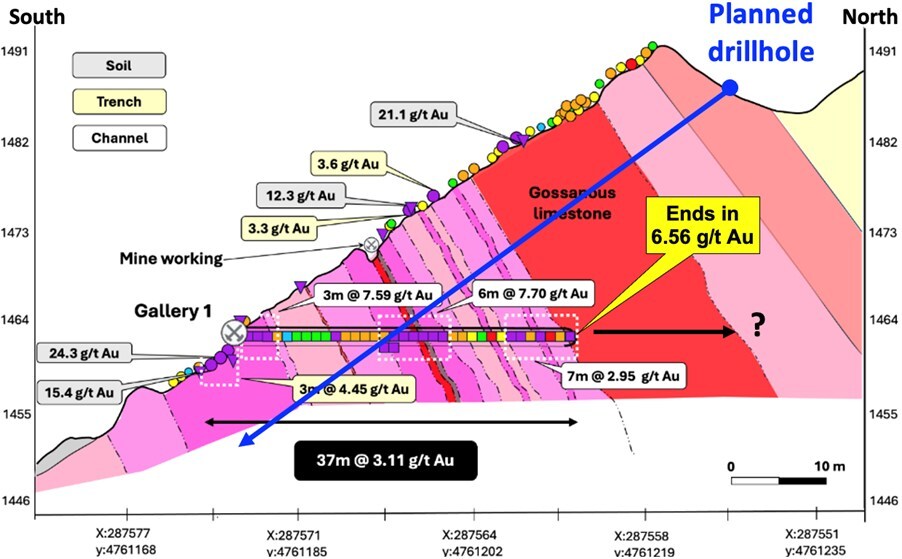

While advancing Escacena, Pan Global continues exploration at its Cármenes Project in northern Spain, approximately 55 kilometers north of León. This secondary project comprises five Investigation Permits covering 5,653 hectares and is located within the same geological belt that hosts Orvana Minerals’ Orovalle copper-gold mining operation and the Salamon gold deposit.

The Cármenes area is prospective for carbonate-hosted breccia pipe-style mineralization, which can form vertically extensive ore bodies potentially containing copper, nickel, cobalt, and gold. Historical mining activities at the Profunda and Providencia sites during the early 20th century primarily focused on copper and cobalt, with additional nickel production until operations ceased in the 1930s.

Current exploration at Cármenes targets multiple breccia-style mineralization bodies, with geology suggesting the potential for mineralized “clusters” that could host several vertically extensive deposits within the same structural corridors.

Pan Global’s strategic focus on copper aligns with global electrification efforts and the European Union’s classification of copper as a Strategic Raw Material. The company is also targeting gold, which continues to trade at historically high prices, enhancing the economic potential of its polymetallic targets.

Both project regions offer favorable conditions for mineral exploration and development, including modern infrastructure, established mining history, available processing capacity, and clear permitting processes. Southern Spain is widely regarded as a tier-one mining jurisdiction, while northern Spain offers similar advantages supporting cost-effective exploration.

As drilling results become available in the coming months, the company expects to provide regular updates that could significantly impact its resource base and future development potential in these historically productive Spanish mining districts.

13 Comments

The CEO’s statement about new discoveries is promising. Does the company have enough funding to follow up on all these targets?

Great point. Financing will be key to sustaining this level of exploration activity.

Spain isn’t the first place that comes to mind for mining, but this progress shows there’s still potential to be unlocked.

Absolutely. Underexplored regions can hold huge rewards—just look at some of the discoveries coming out of Africa or South America lately.

Does anyone else find it interesting that Pan Global is targeting multiple projects simultaneously? Risks and rewards are definitely elevated.

True, but if any of these targets pan out, the upside could be substantial. High-risk, high-reward is the name of the game in exploration.

Exciting to see Pan Global making strides in Spain. Are the copper grades at Escacena competitive with other projects in the region?

Good question. I’d like to see more details on the grades before making a direct comparison, but the focus on polymetallic potential is intriguing.

The combination of copper, tin, and silver makes this deposit stand out. It’s not just about volume but the quality of the resource.

I wonder how the EU’s energy and raw materials strategy will impact projects like these in Spain.

Good observation. Critical minerals are a priority for the EU, so permitting and support could become more favorable.

A maiden resource estimate before year-end could be a major catalyst for this stock.

Absolutely. Investors are always watching for these milestones—especially in junior miners with high-potential projects.