Kingfisher Metals Advances Extensive Drilling Program at BC’s Golden Triangle

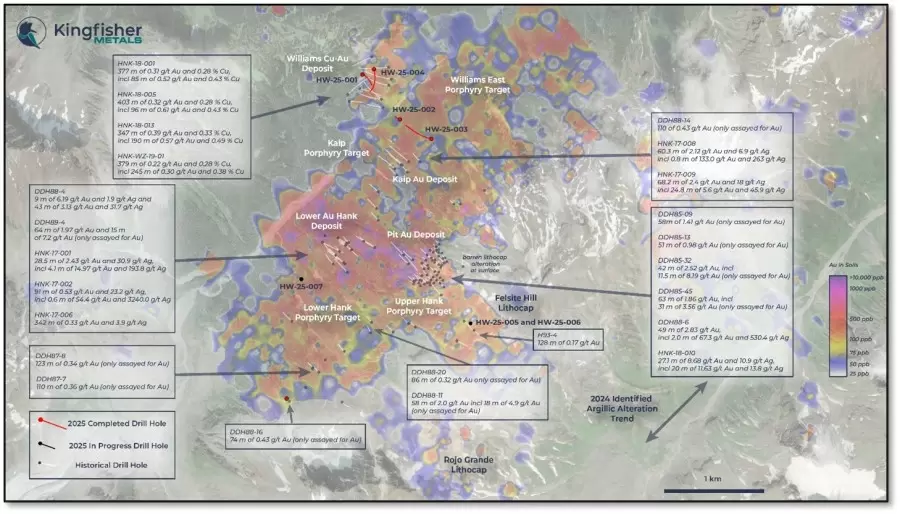

Kingfisher Metals (TSXV:KFR) is making significant progress on its ambitious 7,500-meter drilling campaign at the HWY 37 Project, a sprawling copper-gold exploration initiative in British Columbia’s resource-rich Golden Triangle. The company’s current efforts are concentrated on the Williams porphyry copper-gold system along with additional prospective areas including the Upper and Lower Hank targets.

...

Kingfisher Metals Advances Extensive Drilling Program at BC’s Golden Triangle

Kingfisher Metals (TSXV:KFR) is making significant progress on its ambitious 7,500-meter drilling campaign at the HWY 37 Project, a sprawling copper-gold exploration initiative in British Columbia’s resource-rich Golden Triangle. The company’s current efforts are concentrated on the Williams porphyry copper-gold system along with additional prospective areas including the Upper and Lower Hank targets.

“So far, the 2025 drill program has matched our expectations of vertically extending porphyry mineralization at Williams as well as providing a much clearer understanding of this highly prospective district,” said CEO Dustin Perry. “Our exploration hypothesis indicates vertical continuity of the gold-rich bornite zone, and these holes demonstrate that bornite continues to depth where it was predicted.”

The HWY 37 Project covers an impressive 849 square kilometers, making it one of the largest contiguous land packages in the Golden Triangle. Kingfisher has strategically assembled this substantial position through a combination of purchases and option agreements, positioning itself as a significant player in this prolific mining region known for hosting world-class deposits.

Results from the Williams target area have been particularly encouraging, with drilling successfully extending the known potassic alteration zone and associated copper sulfide mineralization. Hole HW-25-004 intercepted intense potassic alteration across a 478-meter interval containing chalcopyrite and bornite in various forms, including vein, stringer, disseminated, and blebby mineralization.

This mineralized section extends approximately 150 meters beyond the boundaries established by historical drilling, with bornite mineralization now confirmed from surface to a vertical depth of 680 meters. The hole, which terminated at 884.9 meters, continued to show traces of chalcopyrite mineralization right to its bottom.

Positioned upslope and north of the previously identified potassic zone, this drill hole was designed to test deeper extensions of the system. After intersecting the Williams thrust fault at 327 meters, the drill encountered copper-bearing mineralization that continued to the hole’s terminus.

Earlier in the program, hole HW-25-001 was drilled from the western side of the main alteration zone. Despite encountering challenges related to faulting and directional deviation, the hole successfully intersected potassic and phyllic alteration zones containing chalcopyrite and minor bornite from 390 to 726 meters before bottoming in early mineral monzanite at 803 meters.

A significant discovery from this drilling was the identification of two distinct porphyry intrusive phases that had previously been classified as a single unit. This distinction is expected to substantially improve geological modeling and inform more precise targeting for future drilling efforts.

The company has also explored areas southeast of Williams, across Hank Creek, with drill holes HW-25-002 and HW-25-003. These holes were designed to investigate shallow chargeability anomalies and encountered widespread quartz-sericite-pyrite-carbonate alteration in the upper sections before entering a polyphase diatreme breccia. Geologists interpret this breccia as predating the mineralizing events observed at Williams.

Diatreme breccias of this type are commonly associated with porphyry copper-gold systems and typically form either before or after the primary mineralizing phase. The combination of surface mapping and drill data suggests that several targets—including the Kaip and Williams East zones—are situated along the margins of this breccia, potentially hosting porphyry-style mineralization.

At the Upper Hank porphyry target, drilling faced challenges when hole HW-25-005 had to be abandoned at 280 meters due to technical difficulties, falling well short of its planned 800-meter depth. Before termination, the hole passed through a mapped pyrite-rich breccia and encountered two narrow porphyry intrusions displaying mineral textures similar to those seen at Williams. A replacement hole, HW-25-006, is currently being drilled to properly test the deeper chargeability anomaly at this location.

Meanwhile, drilling continues at the Lower Hank porphyry target with hole HW-25-007. This drill is targeting a steep quartz-sericite-pyrite-carbonate body mapped at surface, containing more than 5% pyrite to approximately 200 meters depth. The mineralization is associated with a broad, low-angle plunging zone of copper-gold-silver mineralization identified in historical drilling. Below 250 meters, the drill aims to investigate a strong chargeability anomaly that could indicate the presence of a deeper porphyry system at an elevation comparable to the Williams target.

Beyond drilling operations, Kingfisher is advancing complementary regional exploration activities. An airborne magnetotelluric survey is approximately 65% complete, while induced polarization crews began work in late July, focusing on the Hank-Williams-Mary trend. The company recently completed a soil sampling campaign, collecting over 750 samples to address gaps in historical coverage and extend sampling to new areas of interest.

As drilling and surveys continue, Kingfisher Metals appears well-positioned to expand its understanding of this complex geological system and potentially identify new mineralized zones within its extensive Golden Triangle land package.

35 Comments

Production mix shifting toward Markets might help margins if metals stay firm.

Management hinted at expansion capex; cash flow coverage will matter if prices soften.

Good point. Watching costs and grades like a hawk this year.

Silver leverage is strong here; beta cuts both ways though.

Silver leverage is strong here; beta cuts both ways though.

Good point. Watching costs and grades like a hawk this year.

I like the balance sheet here—less leverage than peers.

Silver leverage is strong here; beta cuts both ways though.

If AISC keeps dropping, this becomes investable for me.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Uranium names keep pushing higher—supply still tight into 2026.

Interesting update on Kingfisher Metals (TSXV:KFR) Reports Progress on HWY 37 Drilling Program in British Columbia’s Golden Triangle. Curious how the grades will trend next quarter.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Interesting update on Kingfisher Metals (TSXV:KFR) Reports Progress on HWY 37 Drilling Program in British Columbia’s Golden Triangle. Curious how the grades will trend next quarter.

Good point. Watching costs and grades like a hawk this year.

Management hinted at expansion capex; cash flow coverage will matter if prices soften.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Production mix shifting toward Markets might help margins if metals stay firm.

Good point. Watching costs and grades like a hawk this year.

Nice to see insider buying—usually a good signal in this space.

Good point. Watching costs and grades like a hawk this year.

Uranium names keep pushing higher—supply still tight into 2026.

Management hinted at expansion capex; cash flow coverage will matter if prices soften.

Good point. Watching costs and grades like a hawk this year.

If AISC keeps dropping, this becomes investable for me.

Exploration results look promising, but permitting will be the key risk.

Good point. Watching costs and grades like a hawk this year.

Silver leverage is strong here; beta cuts both ways though.

Good point. Watching costs and grades like a hawk this year.

Production mix shifting toward Markets might help margins if metals stay firm.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.