The historic Stibnite Mining District in Idaho is once again becoming the epicenter of America’s push to reduce its dependence on foreign antimony, with EVR Resources announcing significant progress in its strategic efforts to revive domestic production of this critical mineral.

The Vancouver-based company revealed this week that it has fully consolidated its land position at the Meadow Creek project, securing 83 claims across 1,660 acres in central Idaho. This strategic acquisition builds

...

The historic Stibnite Mining District in Idaho is once again becoming the epicenter of America’s push to reduce its dependence on foreign antimony, with EVR Resources announcing significant progress in its strategic efforts to revive domestic production of this critical mineral.

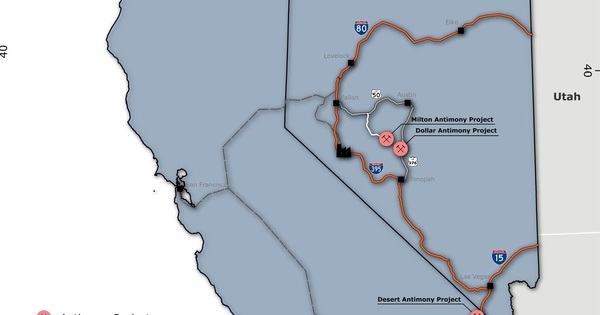

The Vancouver-based company revealed this week that it has fully consolidated its land position at the Meadow Creek project, securing 83 claims across 1,660 acres in central Idaho. This strategic acquisition builds upon EVR’s existing portfolio in the region, which includes the Hermada antimony project located approximately 30 miles southwest of Meadow Creek.

Antimony, designated as a critical mineral by the U.S. government, has seen its strategic importance rise dramatically in recent years. The element is vital for national defense applications, including ammunition, night-vision goggles, and infrared seekers. It also plays a crucial role in the renewable energy transition as a component in flame retardants, lead-acid batteries, and solar panels.

Currently, the United States imports nearly 100% of its antimony supply, with China and Russia controlling roughly 80% of global production. This dependency has created a significant vulnerability in America’s supply chain, particularly as geopolitical tensions continue to rise between these nations and the West.

“The United States has zero domestic antimony production despite its critical status for defense and energy applications,” said Adrian Smith, CEO of EVR Resources. “Our strategic acquisitions in Idaho position us to potentially address this critical supply gap by reviving production in a historically significant mining district.”

The Stibnite district’s antimony production history dates back to World War II, when it supplied the majority of antimony used in the Allied war effort. The area later became a major tungsten producer during the Korean War before operations eventually ceased in the 1990s.

EVR’s Meadow Creek project, which sits approximately 10 miles east of Yellow Pine, Idaho, contains the historically productive Meadow Creek mine that operated in the early 1900s. The company reports that preliminary exploration results show antimony grades exceeding 5% in some surface samples, well above the typical global average of 1-2%.

Industry analysts note that the timing of EVR’s push into antimony aligns with broader government initiatives to reduce foreign mineral dependencies. In 2022, the Department of Defense added antimony to its stockpile acquisition list, and the Inflation Reduction Act provided incentives for domestic production of critical minerals.

“We’re seeing a fundamental shift in how the U.S. approaches critical mineral supply chains,” said Morgan Richardson, a commodities analyst at Harrington Partners. “Companies like EVR that control domestic resources could benefit substantially as government priorities shift toward securing these materials from friendly jurisdictions.”

The antimony market, while relatively small at approximately $2 billion annually, has seen increasing price volatility as supply concerns mount. Prices have fluctuated between $5,000 and $12,000 per ton over the past five years, with recent trends pointing upward as industrial and defense demand grows.

EVR has outlined an aggressive timeline for development at both Meadow Creek and Hermada. Initial geological mapping and sampling programs are already underway, with plans for a more extensive drilling campaign in 2024, pending permit approvals. The company anticipates publishing initial resource estimates by early 2025.

Beyond EVR, the Idaho antimony landscape includes Perpetua Resources’ larger Stibnite Gold Project, which contains significant antimony credits as a by-product of gold production. However, that project has faced regulatory hurdles and environmental concerns, highlighting the challenges of developing mining operations in environmentally sensitive areas.

Environmental considerations remain a key focus for EVR as it advances its projects. The company has emphasized its commitment to modern mining practices that minimize ecological impact, particularly important given the pristine nature of the Idaho wilderness surrounding these projects.

“Responsible development is non-negotiable,” Smith stated. “We recognize that operating in these areas comes with significant environmental responsibilities, and our development plans incorporate best practices for water management, tailings storage, and eventual reclamation.”

As global supply chain vulnerabilities continue to expose the risks of over-reliance on foreign critical minerals, EVR’s Idaho antimony strategy represents a potential piece of America’s mineral security puzzle. Whether the company can successfully navigate the technical, regulatory, and financial challenges of bringing these historic mining areas back into production remains to be seen, but the strategic importance of their efforts aligns clearly with national priorities.