Pacific Ridge Exploration Reports Strong Copper Mineralization at RDP Project in British Columbia

Pacific Ridge Exploration (TSXV: PEX; OTCQB: PEXZF; FSE: PQWN) has released an update on its drilling activities at the wholly-owned RDP copper-gold project in British Columbia’s Golden Horseshoe region. The ongoing exploration program is revealing promising copper mineralization across multiple drill holes at the Day target.

Located approximately 40 kilometers west of the company’s flag

...

Pacific Ridge Exploration Reports Strong Copper Mineralization at RDP Project in British Columbia

Pacific Ridge Exploration (TSXV: PEX; OTCQB: PEXZF; FSE: PQWN) has released an update on its drilling activities at the wholly-owned RDP copper-gold project in British Columbia’s Golden Horseshoe region. The ongoing exploration program is revealing promising copper mineralization across multiple drill holes at the Day target.

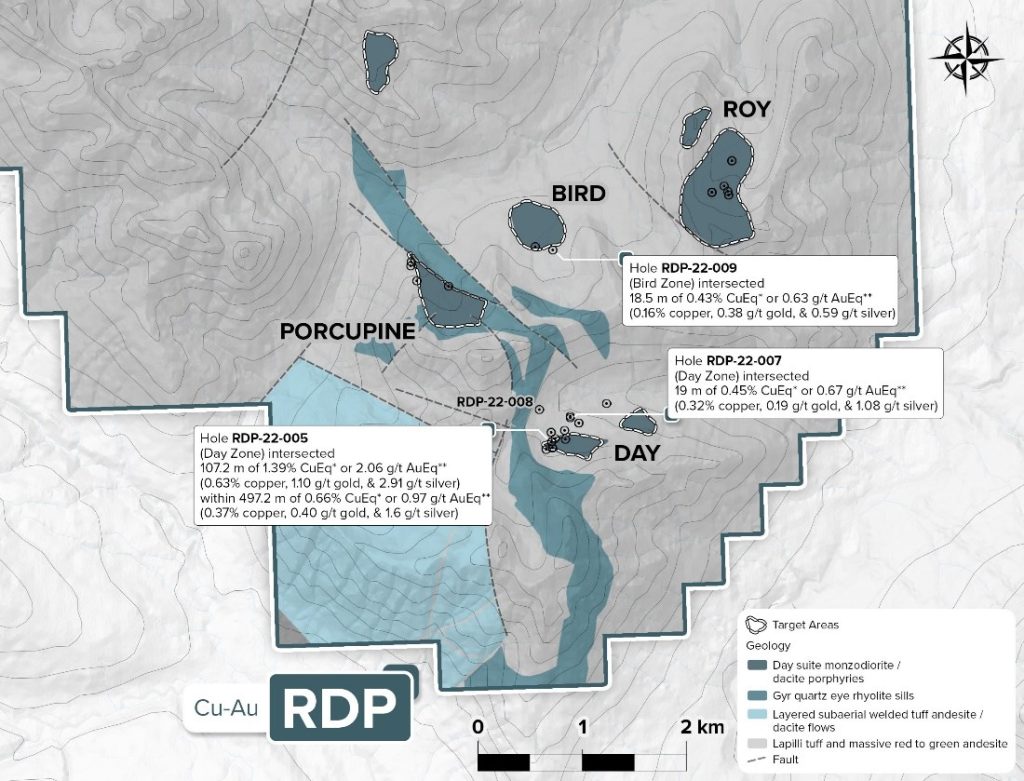

Located approximately 40 kilometers west of the company’s flagship Kliyul copper-gold project, RDP sits at the southern edge of the mineral-rich Toodoggone district in north-central British Columbia. The region has attracted increasing industry attention in recent years due to its porphyry deposit potential.

“We are very pleased with what we are seeing so far,” said Blaine Monaghan, President & CEO of Pacific Ridge. “Strong copper mineralization is present in many of the drill holes and drilling has confirmed that the porphyry copper-gold-silver mineralization at Day is hosted in a tabular body that remains open.”

The company resumed drilling at RDP following exceptional results from its 2022 program, which delivered one of British Columbia’s most significant porphyry copper-gold intersections that year. Drill hole RDP-22-005 encountered 107.2 metres grading 1.39% copper equivalent (CuEq), including 0.63% copper, 1.10 g/t gold, and 2.91 g/t silver. This high-grade zone was part of a broader 497.2-metre interval averaging 0.66% CuEq.

Current drilling operations aim to verify the orientation and extent of a westward-striking, steeply northward-dipping tabular body of porphyry mineralization. The company is utilizing multiple drill pads to test the lateral and depth extensions of this promising zone.

The first hole of the 2025 campaign, RDP-25-010, was positioned approximately 40 metres southwest of the 2022 discovery hole. Despite encountering quartz-magnetite-sulphide veining in the first few metres, the hole intersected a late-mineral intrusive from 5 to 175.5 metres, leading to its early termination.

From the same pad, hole RDP-25-011 reached a depth of 431 metres and was designed to test mineralization beneath and northwest of the discovery hole. The drilling revealed patchy potassic alteration and zones of quartz-magnetite-sulphide veining containing visible chalcopyrite and minor bornite. This successful intercept extended the known mineralization by at least 50 metres northward, with the system remaining open in that direction.

Two additional holes, RDP-25-012 and RDP-25-013, were drilled from a pad located 170 metres northeast of the discovery hole. These holes targeted the continuity of mineralization between previous successful intercepts. Both encountered copper-sulphide mineralization within potassically-altered rock, supporting the company’s geological model of a steeply dipping, tabular mineralized zone.

Notably, RDP-25-013 encountered mineralization to a vertical depth of 500 metres, and the system remains open at depth. This suggests potential for significant resource expansion as exploration continues.

The RDP project is part of Pacific Ridge’s broader portfolio of copper-gold exploration properties in British Columbia, which includes the Kliyul, Chuchi, Onjo, and Redton projects. All are situated within the Quesnel and Stikine terranes, geological formations known for hosting significant porphyry copper-gold deposits that have supported major mining operations in the province.

British Columbia’s Golden Horseshoe region has become increasingly attractive to mining companies seeking copper assets, driven by strong global demand for the metal. Copper’s essential role in renewable energy technologies and electrification has pushed prices higher and sparked renewed interest in porphyry exploration projects.

For Pacific Ridge, the encouraging visual mineralization at RDP represents a potentially significant advancement for the company’s exploration portfolio. While assay results from the current drilling campaign are still pending, the visual indicators of copper mineralization align with the company’s expectations based on previous successful intercepts.

The company continues drilling with hole RDP-25-014 currently in progress from the same pad as RDP-25-011. Pacific Ridge expects to release assay results as they become available, which will provide quantitative data on copper, gold, and silver grades from the current program.

Investors and industry observers will be watching closely as Pacific Ridge works to define what could potentially become a significant new copper-gold resource in one of Canada’s premier mining jurisdictions.

49 Comments

Uranium names keep pushing higher—supply still tight into 2026.

Good point. Watching costs and grades like a hawk this year.

Production mix shifting toward Markets might help margins if metals stay firm.

Good point. Watching costs and grades like a hawk this year.

Silver leverage is strong here; beta cuts both ways though.

Management hinted at expansion capex; cash flow coverage will matter if prices soften.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

If AISC keeps dropping, this becomes investable for me.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

If AISC keeps dropping, this becomes investable for me.

Good point. Watching costs and grades like a hawk this year.

Management hinted at expansion capex; cash flow coverage will matter if prices soften.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Exploration results look promising, but permitting will be the key risk.

Management hinted at expansion capex; cash flow coverage will matter if prices soften.

Production mix shifting toward Markets might help margins if metals stay firm.

Good point. Watching costs and grades like a hawk this year.

Production mix shifting toward Markets might help margins if metals stay firm.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Uranium names keep pushing higher—supply still tight into 2026.

Silver leverage is strong here; beta cuts both ways though.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

If AISC keeps dropping, this becomes investable for me.

I like the balance sheet here—less leverage than peers.

Management hinted at expansion capex; cash flow coverage will matter if prices soften.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Nice to see insider buying—usually a good signal in this space.

Management hinted at expansion capex; cash flow coverage will matter if prices soften.

Good point. Watching costs and grades like a hawk this year.

If AISC keeps dropping, this becomes investable for me.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Production mix shifting toward Markets might help margins if metals stay firm.

Interesting update on Drilling Continues at Pacific Ridge’s RDP Copper-Gold Project in British Columbia

August 26, 2025

|

Posted by: Matthew Evanoff. Curious how the grades will trend next quarter.

Nice to see insider buying—usually a good signal in this space.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

I like the balance sheet here—less leverage than peers.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Exploration results look promising, but permitting will be the key risk.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.