The outlook for copper volumes in 2026 remains uncertain as market analysts express growing concern over supply-demand dynamics in the global metals sector.

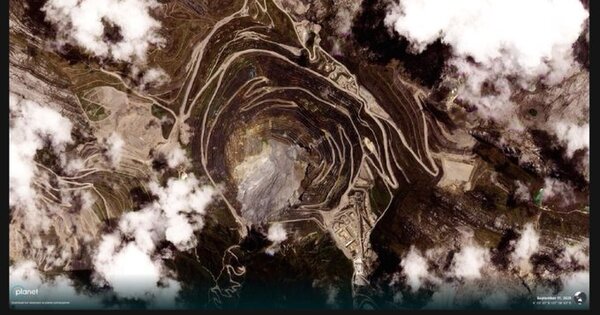

Industry experts point to several factors contributing to this instability, including potential production delays at major mining operations in Chile and Peru, two of the world’s largest copper-producing regions.

The uncertainty comes amid projections of increased demand from renewable energy and electric vehicle sectors, which rely he

...

The outlook for copper volumes in 2026 remains uncertain as market analysts express growing concern over supply-demand dynamics in the global metals sector.

Industry experts point to several factors contributing to this instability, including potential production delays at major mining operations in Chile and Peru, two of the world’s largest copper-producing regions.

The uncertainty comes amid projections of increased demand from renewable energy and electric vehicle sectors, which rely heavily on copper for components and infrastructure.

“We’re seeing mixed signals from both production forecasts and consumption trends,” said a senior commodities analyst at a leading financial institution who requested anonymity. “This makes reliable volume predictions for 2026 particularly challenging.”

Major mining corporations including Freeport-McMoRan, Codelco, and BHP have provided cautious guidance in their long-term outlooks, citing regulatory pressures and potential resource nationalism in key markets.

Investors are closely monitoring infrastructure development in China, historically the largest consumer of copper, where economic policy shifts could significantly impact global demand patterns.

Market volatility is expected to continue as new projects approach decision points on expansion and development timelines over the coming quarters.