Apex Critical Metals Reports Progress on Cap Project Drilling Program in British Columbia

Apex Critical Metals Corp. has provided an update on its ongoing 2025 diamond drilling program at the Cap Critical Minerals Project in central British Columbia, where exploration is targeting potentially valuable niobium and rare earth element (REE) mineralization hosted in carbonatite formations.

“As drilling continues, we are encouraged with the initial mineral observations by our geological team by

...

Apex Critical Metals Reports Progress on Cap Project Drilling Program in British Columbia

Apex Critical Metals Corp. has provided an update on its ongoing 2025 diamond drilling program at the Cap Critical Minerals Project in central British Columbia, where exploration is targeting potentially valuable niobium and rare earth element (REE) mineralization hosted in carbonatite formations.

“As drilling continues, we are encouraged with the initial mineral observations by our geological team by what we’ve now identified within drill core samples, based on visual observations and portable XRF results, as mineralized carbonatite at our Cap project,” said Sean Charland, CEO of Apex, in a company statement.

The Cap Project, wholly owned by Apex (CSE: APXC; OTCQX: APXCF; FWB: KL9), encompasses approximately 2,500 hectares and is located about 85 kilometers northeast of Prince George. The current exploration program operates under a five-year Multi-Year Area-Based permit and has funding for up to 1,500 meters of diamond drilling.

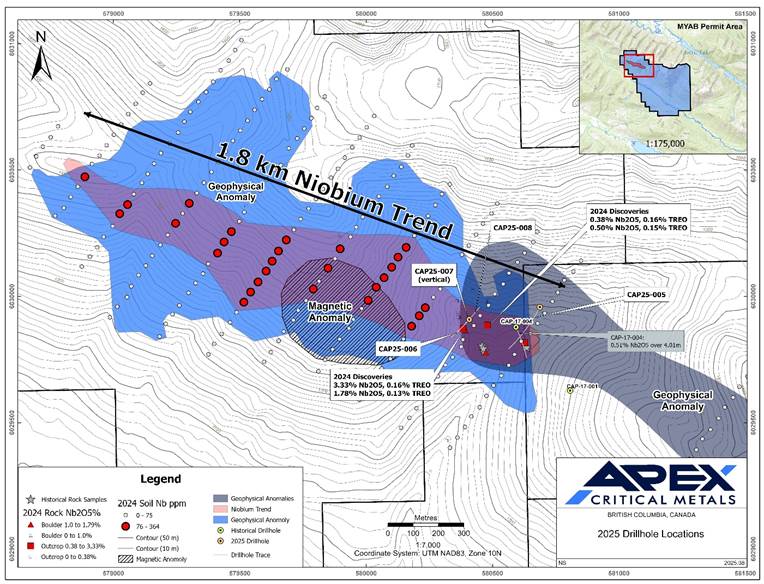

To date, the company has completed four drill holes—CAP25-005 through CAP25-008—totaling 1,097 meters. These holes were strategically positioned near the eastern edge of a previously identified coincident soil geochemical and geophysical anomaly. According to company geologists, all completed holes have intersected varying intervals of carbonatite, fenite, and syenite lithologies, with intersected intervals ranging from just a few meters to over 300 meters in core length.

While the true thickness and geometry of the carbonatite body remain to be confirmed, preliminary geological observations suggest a near-vertical orientation of the carbonatite structure. This information will be critical for future resource modeling if economically viable mineralization is confirmed.

During core logging, geologists have identified visible occurrences of pyrochlore—a mineral known to contain niobium—as well as various rare earth minerals. These observations have been supported by spot checks using portable X-ray fluorescence instruments. However, the company has appropriately cautioned that these findings are preliminary and require verification through comprehensive laboratory analysis before any conclusions can be drawn regarding mineral content or potential economic significance.

Core samples from the first two completed drill holes have already been processed and dispatched to Activation Laboratories Ltd. in Kamloops for detailed analysis. Processing of core from the remaining holes continues, with laboratory results expected to arrive over the coming weeks and into the fall.

The company has implemented rigorous sampling and analytical protocols for the program. All core samples are being prepared at Activation Laboratories’ Kamloops facility following standard procedures including drying, crushing, splitting, and pulverizing. Analytical methods will include XRF analysis for niobium, zirconium, and tantalum; rare earth element assays via lithium metaborate/tetraborate fusion followed by ICP and ICP/MS analysis; and fire assay for gold content.

The sampling program incorporates comprehensive Quality Assurance/Quality Control protocols, including the insertion of certified reference materials and silica blanks at a rate of approximately 5% each to ensure accuracy and reliability of results.

The Cap Project is particularly notable due to its carbonatite-hosted mineral potential. Carbonatites are relatively rare igneous rock formations known globally for hosting economically significant deposits of critical minerals. Major niobium deposits such as Araxá and Catalão in Brazil and Niobec in Quebec are found in carbonatite systems, as are significant REE operations including Mountain Pass in the United States, Mount Weld in Australia, and Bayan Obo in China.

The strategic importance of the Cap Project is heightened by growing global demand for critical minerals essential to modern technologies. Niobium is primarily used in high-strength, low-alloy steels and superalloys for applications in aerospace, energy infrastructure, and automotive industries. Rare earth elements are crucial components in permanent magnets used in electric vehicles, wind turbines, and various electronic devices.

Beyond the Cap Project, Apex Critical Metals maintains a portfolio of other exploration-stage properties focused on critical minerals, including the Bianco Project in northwestern Ontario and the Lac Le Moyne Project in Quebec. The Bianco Project covers 3,735 hectares over a known carbonatite complex, while the Lac Le Moyne Project spans 4,025 hectares near Commerce Resources Corp.’s Eldor Carbonatite Complex.

As Apex continues its exploration activities, results from the current drilling program will inform the next phase of work, potentially including follow-up drilling and more detailed geological modeling to better define the resource potential of the Cap Project.

36 Comments

Exploration results look promising, but permitting will be the key risk.

The cost guidance is better than expected. If they deliver, the stock could rerate.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

If AISC keeps dropping, this becomes investable for me.

Exploration results look promising, but permitting will be the key risk.

Silver leverage is strong here; beta cuts both ways though.

Exploration results look promising, but permitting will be the key risk.

Good point. Watching costs and grades like a hawk this year.

I like the balance sheet here—less leverage than peers.

Good point. Watching costs and grades like a hawk this year.

Nice to see insider buying—usually a good signal in this space.

Nice to see insider buying—usually a good signal in this space.

Interesting update on Apex Critical Metals (CSE:APXC) Provides Update on 2025 Drill Program at Cap Project in Central British Columbia

August 20, 2025

|

Posted by: Matthew Evanoff. Curious how the grades will trend next quarter.

Silver leverage is strong here; beta cuts both ways though.

Production mix shifting toward Markets might help margins if metals stay firm.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

If AISC keeps dropping, this becomes investable for me.

Production mix shifting toward Markets might help margins if metals stay firm.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Nice to see insider buying—usually a good signal in this space.

If AISC keeps dropping, this becomes investable for me.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Nice to see insider buying—usually a good signal in this space.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Nice to see insider buying—usually a good signal in this space.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.

Interesting update on Apex Critical Metals (CSE:APXC) Provides Update on 2025 Drill Program at Cap Project in Central British Columbia

August 20, 2025

|

Posted by: Matthew Evanoff. Curious how the grades will trend next quarter.

If AISC keeps dropping, this becomes investable for me.

Good point. Watching costs and grades like a hawk this year.

Good point. Watching costs and grades like a hawk this year.