Listen to the article

Cipher Mining’s (CIFR) $3B HPC deal should have been a catalyst, but the stock went sideways as a $1.3B convertible raise stole the spotlight. Here’s why institutions rushed in, and what it means for shareholders.

The following guest post comes from BitcoinMiningStock.io, a public markets intelligence platform delivering data on companies exposed to Bitcoin mining and crypto treasury strategies. Originally published on Oct. 1, 2025, by Cindy Feng.

Cipher Mining recently announced its first hyperscale deal, revealing Fluidstack as its HPC client, the same Google-backed partner TeraWulf signed earlier this year. This marks the fourth major HPC hosting contract among public miners, reinforcing the sector’s pivot into HPC as a complement to Bitcoin mining.

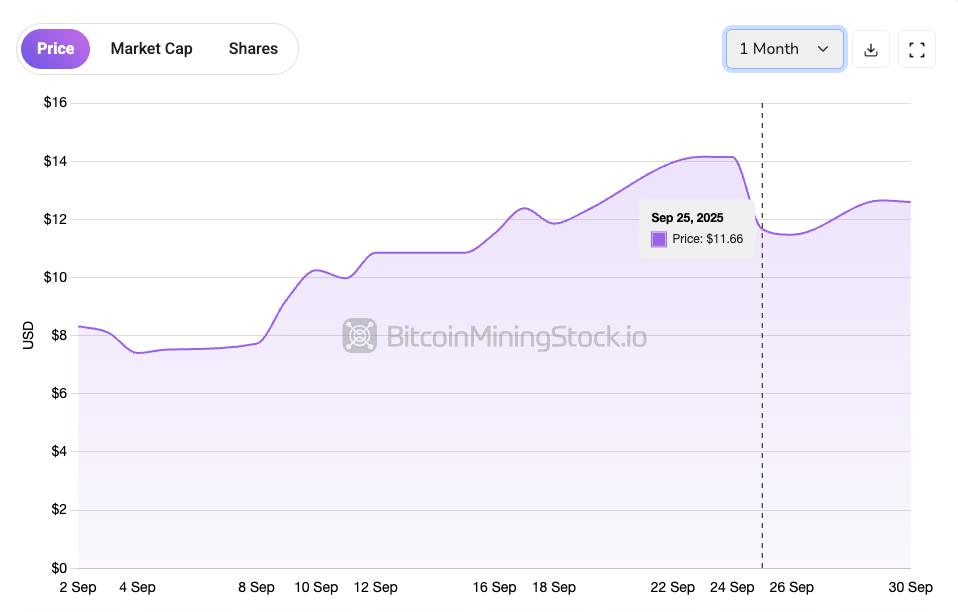

Typically, such announcements spark a sustained rally. This time, Cipher’s stock initially ticked up but quickly fell after unveiling a large private financing. Within 24 hours, an $800 million private convertible note offering upsized to $1.1 billion on overwhelming institutional demand. On social media, investors blamed the convertibles for killing momentum. Such perception is understandable, but it’s also a reminder that heavy upfront costs are required to make HPC/AI profits real.

Now let’s unpack the mechanics of this financing deal, because we’ll find out why institutions rushed in and shareholders reacted cautiously.

HPC Economics and the Financing Link

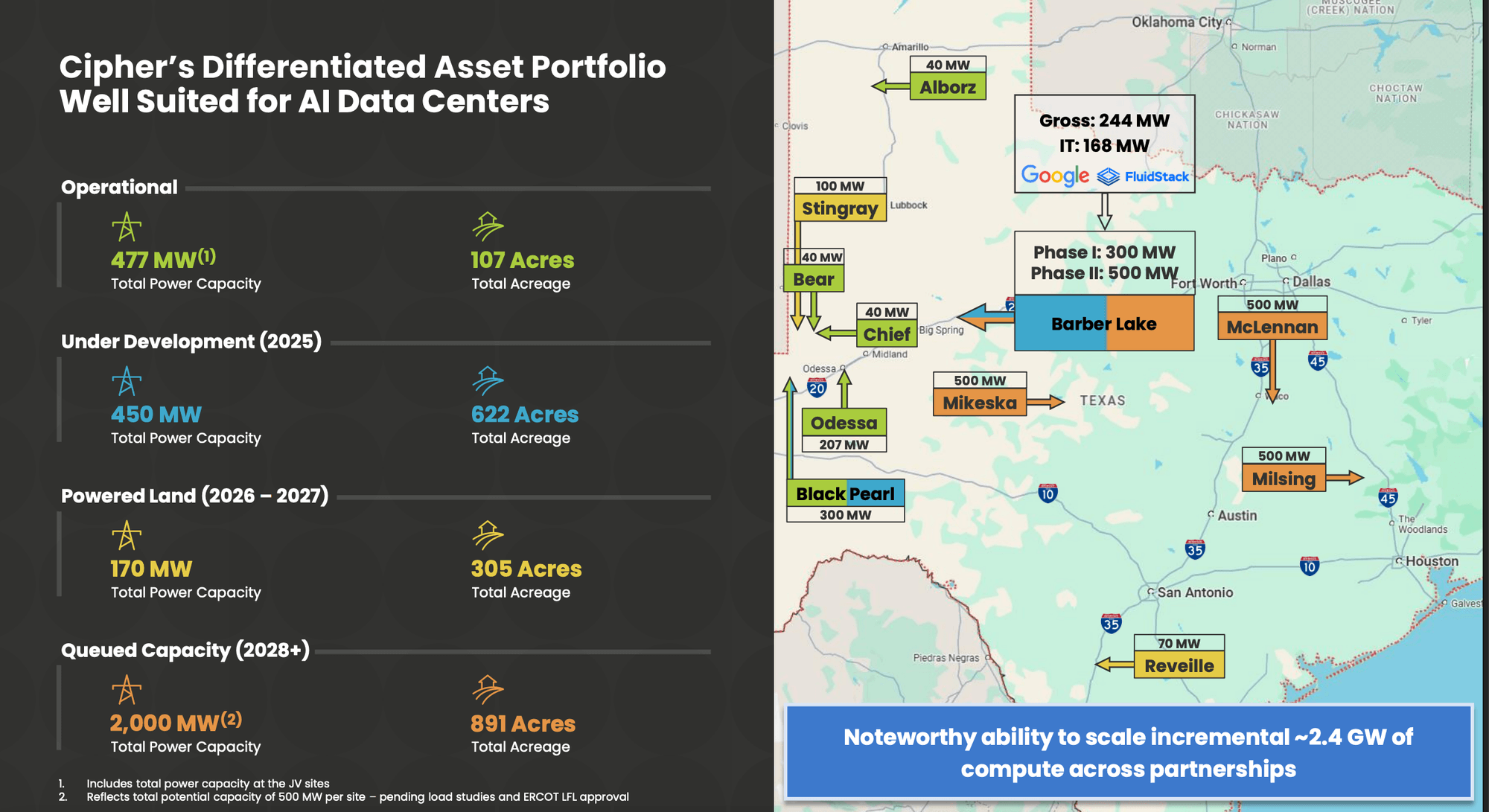

Barber Lake site and Cipher’s broader 2.4 GW pipeline are the backbone of its HPC strategy. Hosting hyperscalers requires massive upfront spending on land, power interconnection, and data center buildout. The Fluidstack contract validated demand, but capital was the bottleneck.

*Barber Lake’s 168MW build alone is expected to require roughly $1.5B – $1.8B in capex, even before factoring in the additional spend needed to fully leverage Cipher’s broader energy pipeline.

That’s where the convertibles come in. The $1.1B raise is not an afterthought to the HPC story, it is a necessary step. By securing long-dated capital at zero interest, Cipher bought itself the time and resources to execute. Yet in doing so, management shifted risk from operations to equity structure.

Breaking Down the Convertible Notes

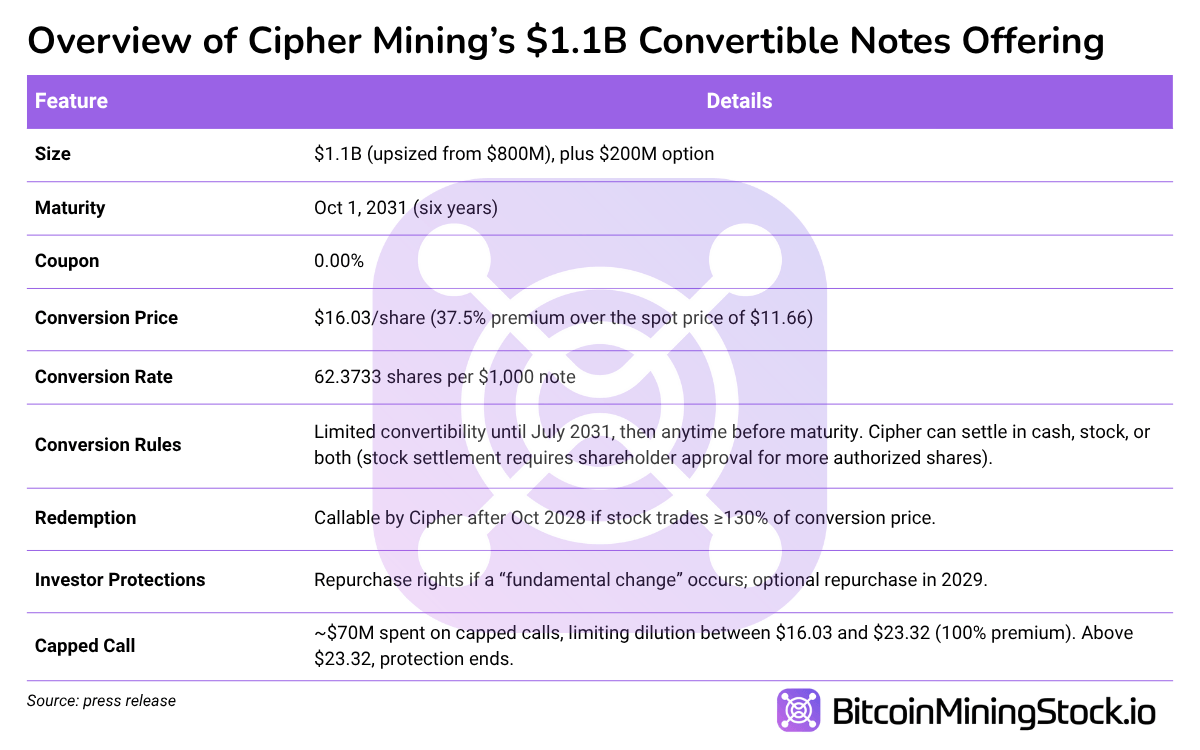

Cipher priced 0.00% convertible senior notes due October 1, 2031, scheduled to settle on September 30, 2025. The deal was upsized from $800M to $1.1Balmost immediately, with an additional $200M option*, which reflected the overwhelming institutional demand.

*The $200M purchase option was exercised, per Cipher’s Form 8-K, bringing the total convertible notes issued to $1.3 billion.

Relative to peer miners, the deal (6-year funding at 0% interest rate) looks cheap. Some have paid 10%+ interest rates for debts or relied on serial equity issuance. On top of that, Cipher intends to use $70M to fund the cost of entering into the capped call transactions, which helps reduce dilution if stock rises. In other words, shareholders are shielded from dilution up to $23.32 per share (almost 2x the reported sale price on September 25, 2025).

Why Institutions Rushed In

At first glance this private offering, paying no interest and being locked until 2031, looks unattractive. But a convertible note isn’t a plain bond, it’s essentially a loan plus a call option on the stock. Investors get par repayment in 2031 if Cipher struggles, but if the stock rises above $16.03, they can convert into equity and capture upside.

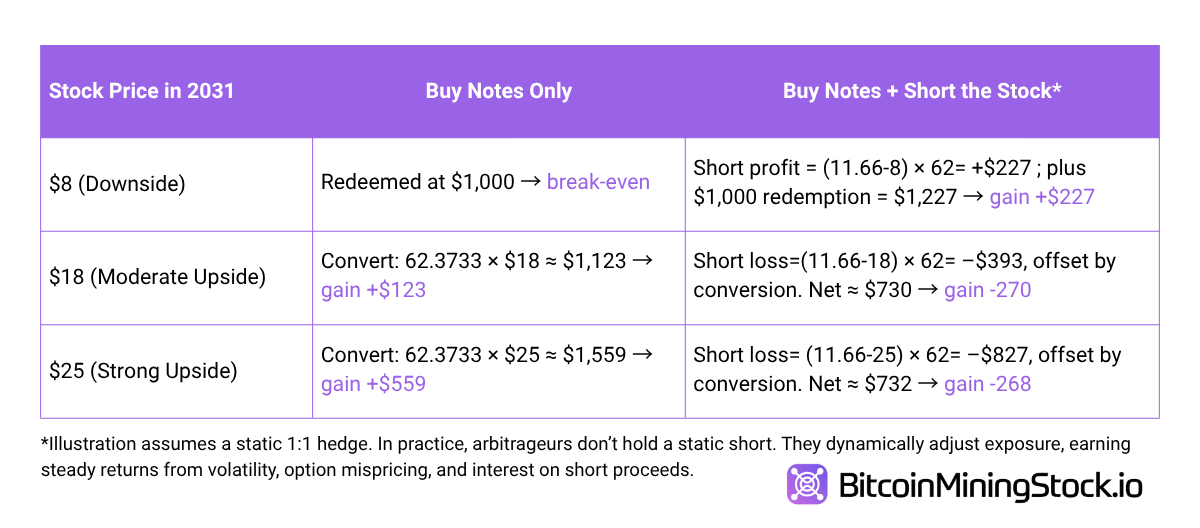

For hedge funds, the attraction goes beyond simple long-term exposure. Many run convertible arbitrage strategies, where they buy the notes and short a stock in proportion to the conversion ratio. The short hedge is then dynamically adjusted as the stock price moves. The goal isn’t to bet on a company’s fundamentals, but to profit from the option-like structure and volatility of the stock.

To illustrate, assume an investor buys $1,000 face value of notes (62.3733 shares if converted). Cipher’s stock was $11.66 ; conversion is at $16.03.

With a static setup, outcomes would look like :

So what does this mean? Even though the static math looks unattractive for arbitrageurs at higher prices, dynamic hedging is what makes the strategy profitable across outcomes. That’s why institutions piled in: they get a structure that offers bond-like protection with option-like upside, while common shareholders only gain if Cipher executes successfully. This explains why the deal was upsized within hours.

How Dilution Works for Shareholders

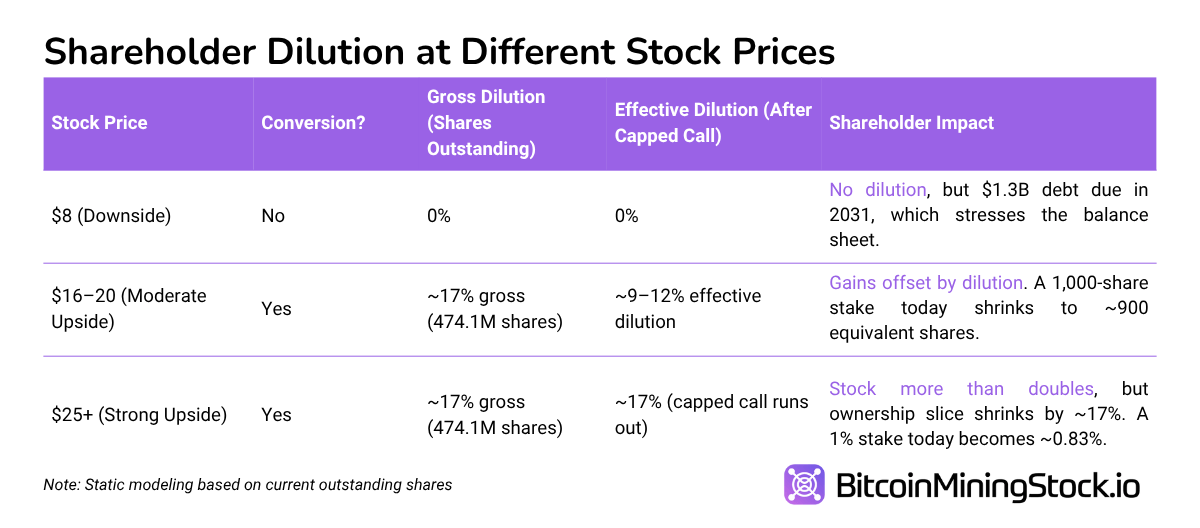

For common equity holders, the impact is straightforward and far less flexible than it is for institutions. Cipher currently has ~393M shares outstanding. If all notes convert, ~81.1M new shares will be issued, lifting the total to ~474.1M, a ~17% dilution. The capped call trims this to 9-12% if shares land between $16.03 and $23.32, but beyond that (>$23.32) the protection runs out and shareholders absorb full dilution.

The asymmetry here: institutions can fine-tune their risk and lock in returns through hedging, but shareholders cannot. Equity investors have a binary outcome: either Cipher executes and the stock appreciates enough to outweigh 9–17% dilution, or it doesn’t and they are left with a weaker stock plus $1.3B of debt hanging over the company.

Final Thoughts

Cipher’s Fluidstack contract validates its strategic shift into HPC and AI hosting. Like Core Scientific, Applied Digital, and TeraWulf, the company is leveraging energy and infrastructure to attract hyperscale clients, aiming for revenue streams that are far more predictable than pure Bitcoin mining.

Yet the muted stock reaction shows how financing can overshadow even the most positive headlines. The $1.3 billion convertible notes, structured smartly with no immediate cash drain and capped call protection, still represent a substantial future claim on equity. Shareholders face 9–17% dilution if Cipher executes, but that dilution would only come at significantly higher share prices.

This tension explains the divergence: the HPC deal is a clear strategic win, but the financing reframed investor focus toward risk. Cipher is front-loading capital to build Barber Lake and activate its 2.4 GW pipeline, a necessary step if it wants to monetize HPC demand at scale. If execution is on time and Barber Lake’s 168 MW comes online by September 2026 as planned, the resulting revenues could more than outweigh dilution.

For now, the convertibles give institutions a low-risk, option-like entry point, while shareholders carry the execution risk. The HPC story remains compelling, but until tangible revenues materialize, the market will see Cipher less for its Fluidstack deal and more for the $1.3 billion financing it used to fund it.