Listen to the article

When gold smashes through $4,000 an ounce and Bitcoin hovers above $120,000, investors are forced to ask the obvious question: which asset will deliver bigger gains in the weeks ahead? Both are riding historic momentum, but for very different reasons. Gold is being fueled by fear, safe-haven demand, and central bank buying, while Bitcoin thrives on speculation, liquidity, and its growing role as a hedge against fiat debasement. The next two months could be pivotal for Bitcoin vs Gold, and the charts hint that the answer may not be as straightforward as it seems.

Bitcoin vs Gold: Why Gold Just Crossed $4,000?

XAU/USD Daily Chart- TradingView

Gold price has finally cracked the $4,000 level, a psychological barrier that signals how investors are treating it as a lifeline in a shaky global economy. Record inflows into gold ETFs, central banks hoarding reserves, and a weaker U.S. dollar are all pushing the metal into uncharted territory. Goldman Sachs now projects gold could move toward $4,900 by 2026, with analysts calling the current rally a “debasement trade” – investors hedging against currency erosion and U.S. debt concerns.

On the chart, Gold price shows a sharp uptrend since early September, riding well above the 20-day moving average and pressing against the upper Bollinger Band. Momentum is clear. Unless it slips below the $3,715 support (20-day MA), the bullish structure remains intact. With safe-haven demand, gold is positioned to climb higher, possibly testing the $4,200–$4,400 zone in the coming two months if ETF inflows continue and the dollar remains weak.

Bitcoin’s Position After a Steep Rally

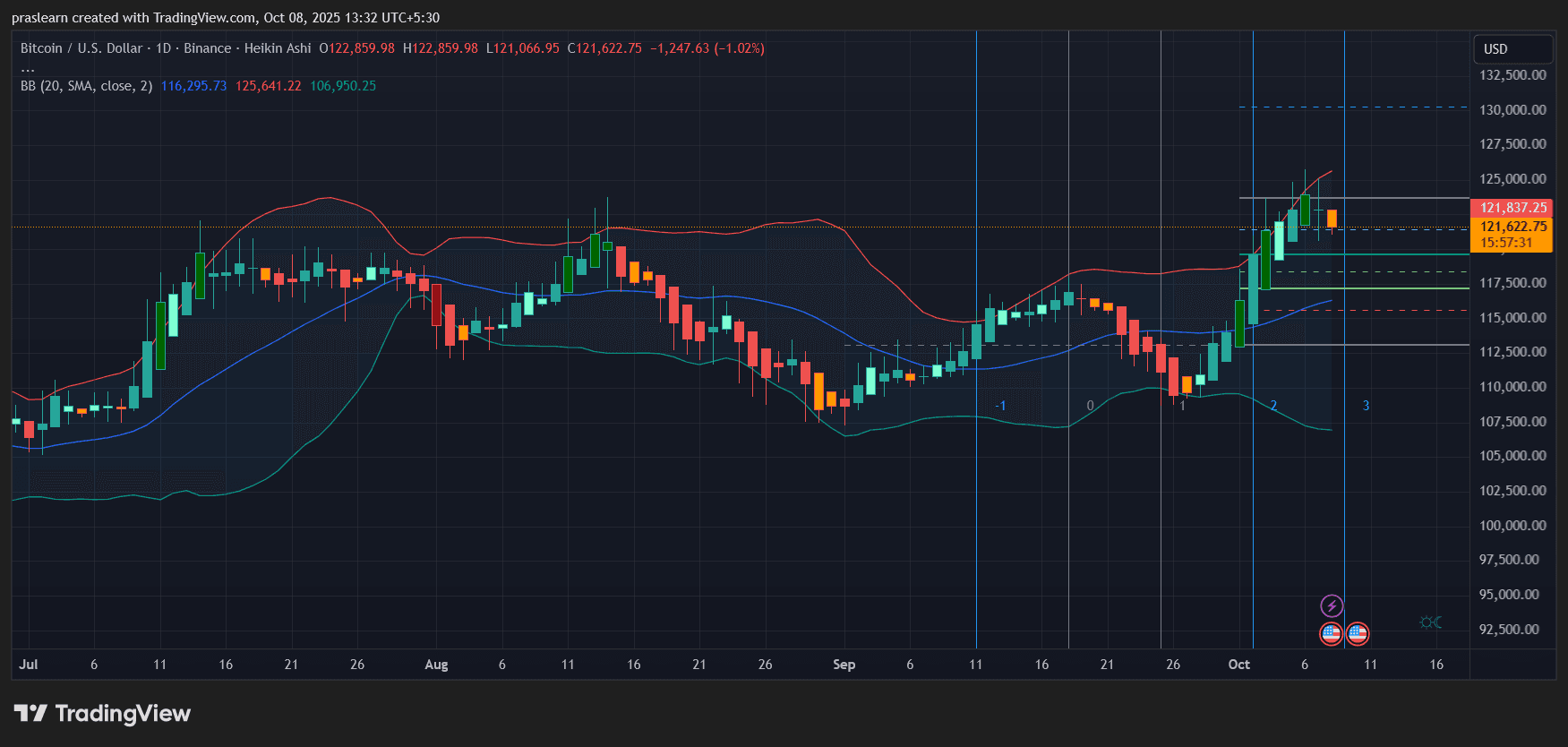

BTC/USD Daily Chart- TradingView

Bitcoin price, in contrast, has had a rollercoaster run. After rallying past $125,000 earlier this month, it has faced selling pressure, pulling back to around $121,600. The chart shows BTC running into resistance at the top Bollinger Band before reversing. Unlike gold, which is in a smooth trend, Bitcoin looks choppier, with strong upward bursts followed by equally sharp corrections.

That said, Bitcoin price remains well above its September lows near $107,000. If buyers defend the $118,000–$117,000 zone, BTC could quickly resume its push toward $127,000 and then $132,500. The key risk? Bitcoin is much more sensitive to liquidity shocks. Any rebound in the U.S. dollar or risk-off move in equities could temporarily dampen its momentum.

Comparing Profit Potential: Gold vs Bitcoin

So which asset offers more upside in the next 2 months? Gold has momentum, structural demand from institutions and central banks, and a weakening dollar at its back. It’s the “safer” bet with a likely steady climb. A 5–10% gain from current levels seems achievable, especially if geopolitical risk headlines pile up.

Bitcoin price, on the other hand, is more volatile but also carries higher potential rewards. If the $118,000 support holds, BTC could rally 8–12% in weeks, outpacing gold’s returns. However, failure to hold support risks a fall back toward $112,000, which would wipe out short-term bullishness.

The Dollar Factor and Stock Market Turbulence

Both assets are tethered to one common driver: the U.S. dollar. The World Gold Council’s research is clear – gold’s strongest rallies happen when the dollar weakens. Bitcoin, though often framed as “digital gold,” sometimes struggles when liquidity dries up, even if the dollar falls. With October historically a turbulent month for equities, a correction in stocks could fuel demand for gold first, and then Bitcoin if risk appetite re-emerges.

Bitcoin vs Gold: Who Wins the Next 2 Months?

If you’re looking for stability and a hedge, gold edges ahead. Its breakout above $4,000 looks durable, supported by institutional inflows and central bank buying. But if you’re chasing sharper gains and can stomach volatility, Bitcoin has the bigger profit potential.

The likely scenario? Gold grinds higher to $4,200–$4,400 into year-end, while Bitcoin tests $127,000–$132,000 with more turbulence along the way. Investors who balance both – gold for security and Bitcoin for growth – may find the best overall return.