Listen to the article

Bitcoin and gold have outperformed every other major asset class this year, reflecting how US macroeconomic uncertainty is reshaping investor behavior.

Gold has surged 48% year to date, reaching an all-time high near $4000. In comparison, Bitcoin has gained over 30% this year and has reached a new high above $126,000. Notably, this marks the first time the two assets have simultaneously held the top performance spots in any calendar year.

Both rallies stem from the same underlying forces: a search for safety as U.S. fiscal conditions deteriorate and expectations grow that the Federal Reserve will pivot to rate cuts.

With the federal government grappling with ballooning debt and the risk of a prolonged shutdown, investors are increasingly funneling liquidity into assets that can preserve purchasing power.

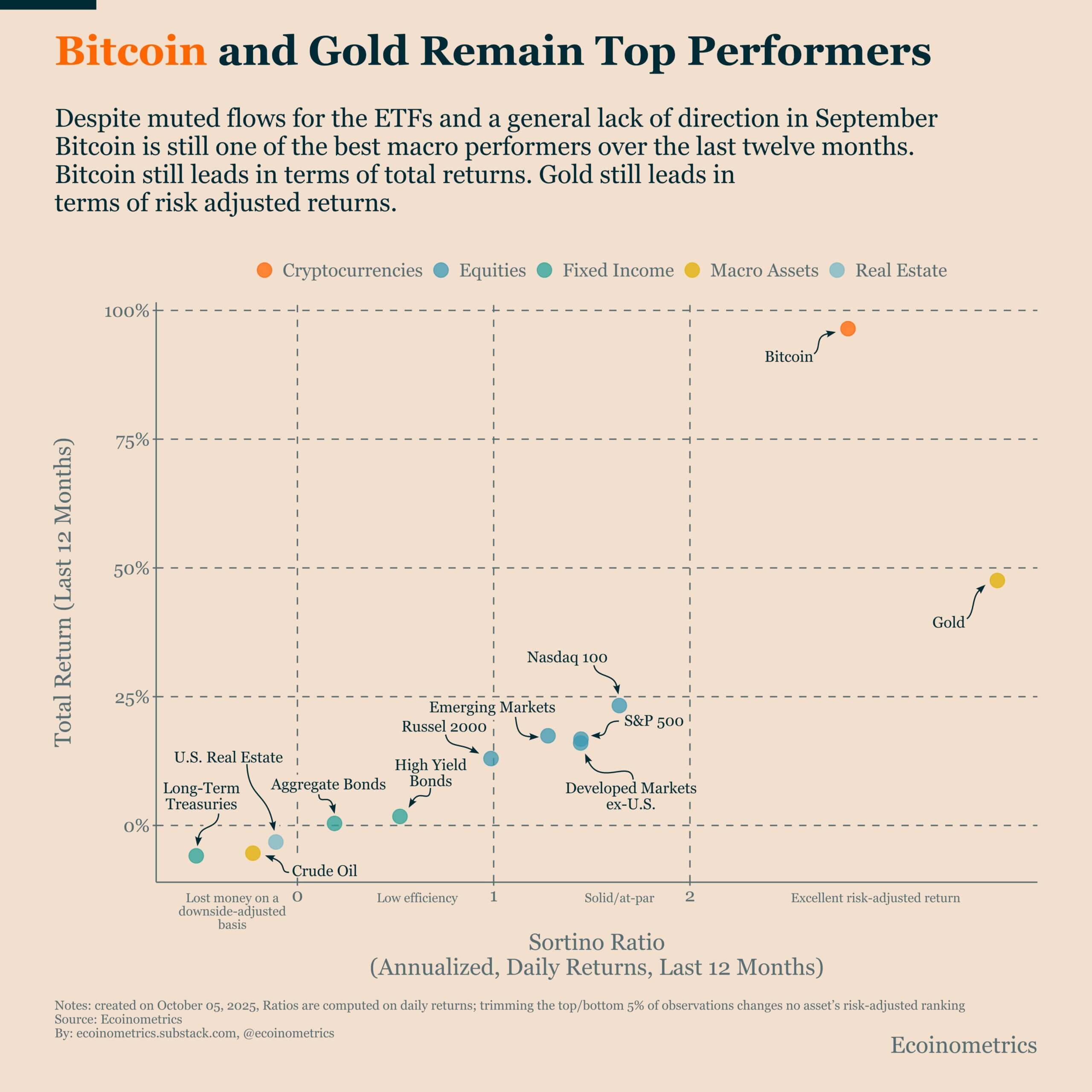

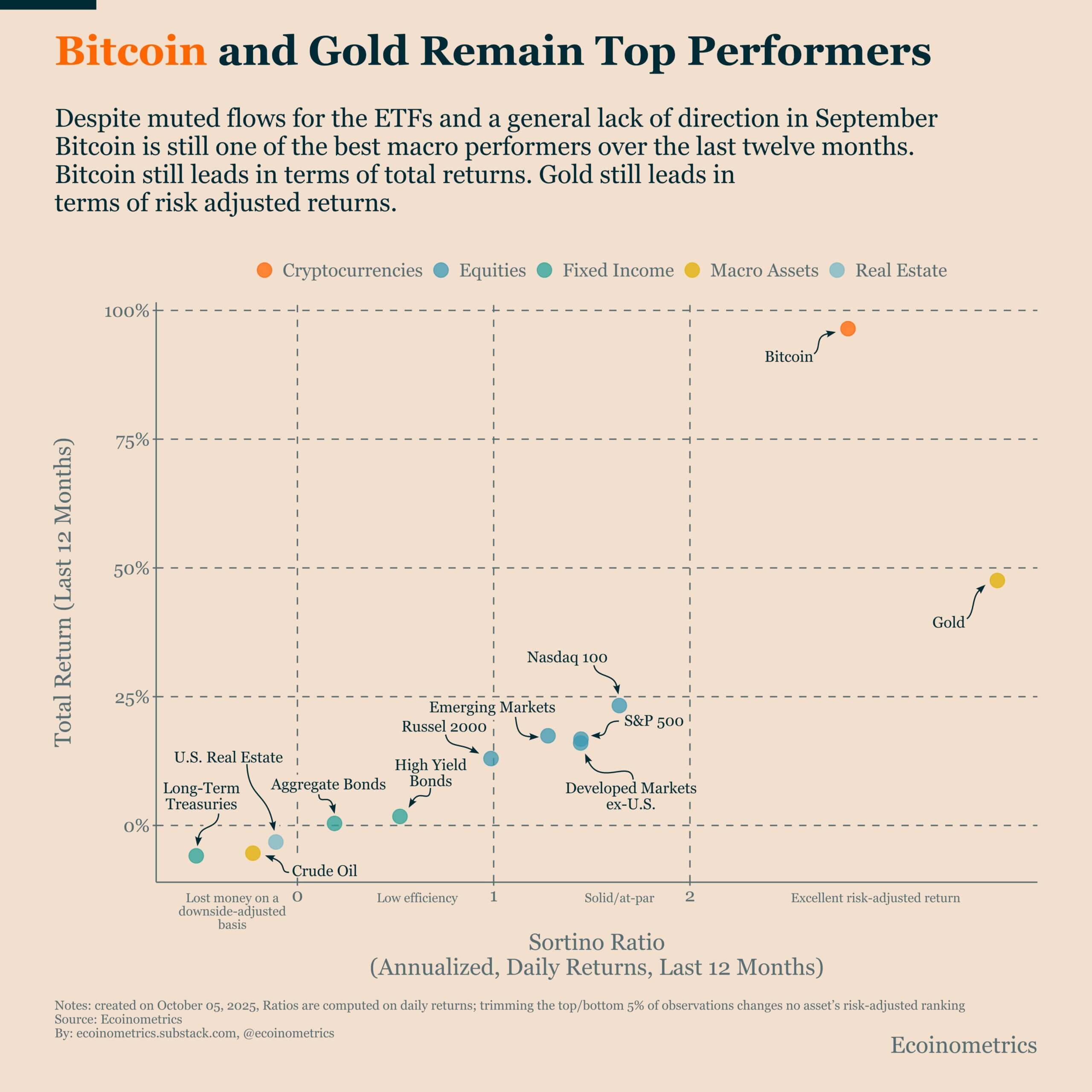

Ecoinometrics, a macro analysis platform, also corroborated this view.

It noted that while Bitcoin leads in total returns, gold continues to outperform on a risk-adjusted basis.

According to the firm, this pattern has held for the past two years, and this consistency signals a sustained preference for hard assets as US debt climbs and fiscal dominance becomes the new economic reality.

The firm added that investors betting on Bitcoin and gold are simply hedging against what they see as a slow erosion of fiat currency value.

Bitcoin’s long-term edge over Gold

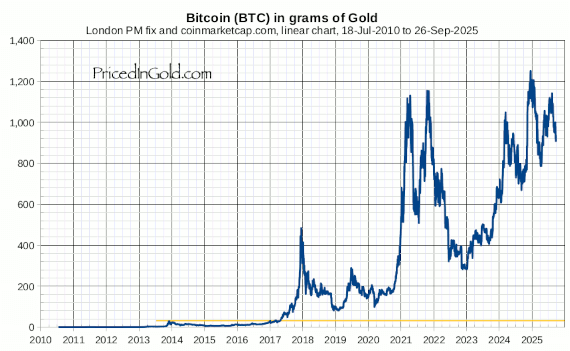

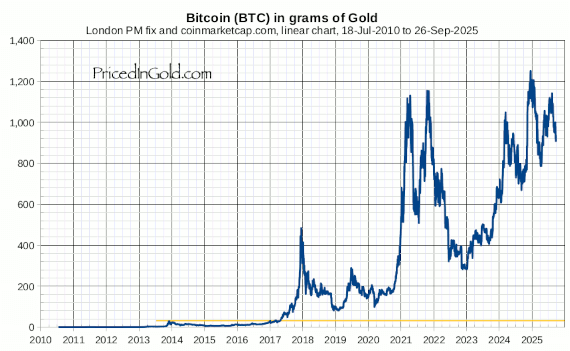

While both assets are receiving praise for their current market performance, there is an increasing belief that BTC could soon upstage gold.

In an Oct. 7 post on X (formerly Twitter), Matthew Sigel, head of digital assets research at VanEck, said Bitcoin could reach half of gold’s market capitalization after the next halving in April 2028. A halving event cuts Bitcoin’s issuance rate by 50%, reducing supply and typically driving price appreciation when demand holds steady.

Sigel emphasized that younger investors, particularly in emerging markets, increasingly view Bitcoin as a superior store of value to the precious metal. Gold’s worth, he noted, largely stems from its role as a value reserve rather than from industrial or jewelry demand.

So, if Bitcoin continues capturing that perception advantage, its market could expand substantially. At gold’s current record price, Sigel calculated an equivalent valuation of $644,000 per BTC.

Notably, several industry veterans share in his optimism.

Dave Weisberger, the founder of CoinRoutes, argued that Bitcoin’s “real bull market” has not yet begun when measured against gold.

Considering this, he expects Bitcoin to outperform gold in the coming cycles as it cements its position as the “preeminent hard money.”

Weisberger stated:

“When the real Bitcoin bull market starts, you will know it from the expressions of disbelief that echo around this platform… Until then, Bitcoin WILL garner its share of increasing global liquidity, but the real fireworks are in the (unpredictable) future.”

Likewise, David Marcus, former PayPal president, remarked that if Bitcoin were valued like gold, its fair price would exceed $1.3 million per coin.

Their confidence rests on Bitcoin’s technological edge over the physical bullion.

Unlike gold, Bitcoin is digital, divisible, and transferable across borders without intermediaries. It also offers programmable utility, enabling new financial use cases that traditional commodities cannot replicate.

While the global economy still relies on fiat currencies for trade, shifting geopolitics and growing distrust in government-backed money could gradually push Bitcoin closer to gold’s centuries-old role as a universal store of value.