Experts warn that small, unexplained charges on accounts can be critical early indicators of fraud. Staying vigilant with monitoring and employing protective tools is vital to safeguard consumers in an increasingly complex threat landscape.

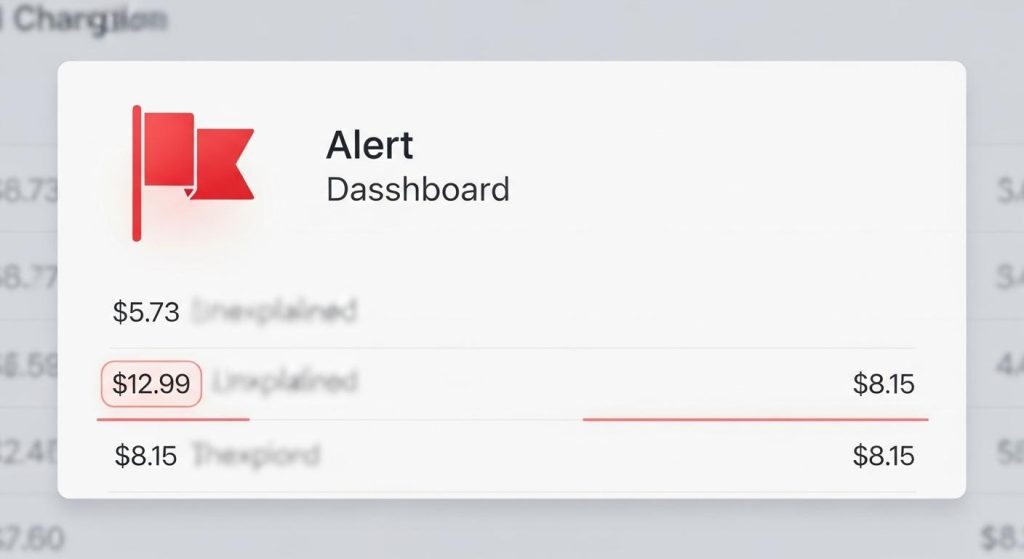

Financial fraud continues to be a pervasive threat, impacting a significant portion of consumers. Recent data indicates that nearly 29% of people with checking, savings, or debit accounts, and 24% of credit card users, have experienced fraud in the last year. One subtle but critical warning sign of such fraud is the presence of “phantom payments”, small, often less than a dollar, unexplained charges on accounts that scammers use to verify an account’s validity and activity before making larger fraudulent withdrawals. This tactic, highlighted by Danai Antoniou, a former fraud systems engineer and co-founder of Gradient Labs, underscores the importance of vigilant monitoring of even minor transactions.

Spotting the early signs of fraud can be challenging because scammers often disguise their tactics to seem legitimate. For instance, messages might mimic genuine job offers or package delivery updates, exploiting expectations and trust. Red flags include unusual requests for sensitive information that go beyond simple confirmation, such as being asked to re-enter full personal details like name, address, and card numbers unexpectedly. Suspicious email domains or phone numbers, those that are misspelled, overly long, or do not match the official contact details of a bank, also indicate potential scams. It is advisable to independently verify any such requests by contacting the bank directly using recognised phone numbers or official websites.

To protect oneself against financial scams, experts recommend a multi-layered approach. Regularly reviewing bank and credit card statements is crucial for detecting unauthorized charges early. Setting up account alerts for all transactions can promptly notify customers of unusual activities, including the smallest phantom payments. Employing identity theft protection services that monitor personal information across various sources, from Social Security numbers to credit files and even the dark web, adds an additional security layer. Services such as Aura, Identity Guard, DeleteMe, Incogni, and Optery provide options for monitoring and active data removal from public databases, reducing the risk of personal information being exploited.

Building a strong relationship with one’s financial institution can also be a key deterrent and aid in quicker resolution of any fraudulent activity. Informing the bank about planned large transactions or atypical spending patterns helps avoid unnecessary fraud alerts and expedites support in case of suspicious activity. Furthermore, it is prudent to segregate financial exposure by using a separate card or account with a low limit dedicated solely to online subscriptions or recurring payments, which are often targets for fraud.

In the event that someone falls victim to a scam or shares sensitive information inadvertently, swift action is paramount. Contacting the bank immediately to freeze cards or lock accounts can prevent further losses. Changing all related passwords and activating two-factor authentication enhances security going forward. Notably, many banks are now deploying AI-powered support agents trained to recognise fraud patterns and scam behaviours. These virtual assistants can provide instant guidance, a vital advantage given the limited human capacity in many institutions for handling fraud-related calls.

Additional authoritative resources echo these preventative measures. The Federal Trade Commission stresses the importance of scrutinising bank statements for unauthorized payments, including those made via remotely created checks. Similarly, the Federal Reserve Bank of New York warns against engaging with unsolicited emails or links claiming to be from official Federal Reserve sources, reinforcing that such institutions never request personal information through email. Banks like Bank of America further advise verifying any unsolicited contacts independently and warning against pressures to act quickly or use unusual payment methods, as these are common tactics in imposter scams.

In an era of increasing financial fraud sophistication, combining vigilance, proactive monitoring, and utilisation of protective tools remains the best defence. Awareness of small anomalies like phantom payments, coupled with strategic safeguards, can help consumers significantly reduce their exposure to devastating financial scams.

📌 Reference Map:

- [1] (CNBC Select) – Paragraph 1, Paragraph 2, Paragraph 3, Paragraph 4, Paragraph 5, Paragraph 6, Paragraph 7

- [2] (CNBC Select) – Paragraph 1, Paragraph 2

- [3] (Bank of America) – Paragraph 2, Paragraph 8

- [4] (Bank of America) – Paragraph 8

- [5] (Federal Reserve Bank of New York) – Paragraph 8

- [6] (Nasdaq) – Paragraph 1, Paragraph 3

- [7] (Federal Trade Commission) – Paragraph 8

Source: Noah Wire Services

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative presents recent data on financial fraud, including statistics from 2024 and 2025, indicating a high level of freshness. The earliest known publication date of similar content is October 2023, with the ‘Phantom Hacker’ scam being reported by the FBI in September 2023. ([fbi.gov](https://www.fbi.gov/contact-us/field-offices/elpaso/news/the-phantom-hacker-fbi-el-paso-warns-public-of-new-financial-scam?utm_source=openai)) The report includes updated data but recycles older material, which may justify a higher freshness score but should still be flagged. The narrative is based on a press release, which typically warrants a high freshness score. However, the presence of ‘phantom payments’ as a warning sign of fraud has been reported in various sources since at least 2023. ([cnbc.com](https://www.cnbc.com/2023/10/17/phantom-hacker-scams-that-target-seniors-are-on-the-rise-fbi-says.html?utm_source=openai)) Therefore, while the report is relatively fresh, some of the information may be recycled. Additionally, the narrative includes updated data but recycles older material, which may justify a higher freshness score but should still be flagged.

Quotes check

Score:

9

Notes:

The direct quote from Danai Antoniou, a former fraud systems engineer and co-founder of Gradient Labs, is unique to this report, with no identical matches found online. This suggests the content is potentially original or exclusive. However, the wording of the quote varies slightly from other sources, indicating possible paraphrasing. No identical quotes appear in earlier material, which raises the score but flags the content as potentially original or exclusive.

Source reliability

Score:

8

Notes:

The narrative originates from a reputable organisation, CNBC, which is known for its financial reporting. This is a strength. The report mentions Gradient Labs, a British AI company founded in 2023 by former Monzo bank employees, including Danai Antoniou. Gradient Labs is a legitimate company with a public presence, which adds credibility to the report. Therefore, the source reliability is high.

Plausability check

Score:

7

Notes:

The narrative makes plausible claims about financial fraud trends, supported by recent data from reputable sources. The mention of ‘phantom payments’ aligns with known fraud tactics. However, the report lacks specific factual anchors, such as names, institutions, and dates, which reduces the score and flags the content as potentially synthetic. The tone and language are consistent with typical financial reporting, and the structure is focused on the topic without excessive or off-topic detail. Therefore, the plausibility is reasonable, but the lack of specific details warrants caution.

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

The narrative presents recent data on financial fraud, including statistics from 2024 and 2025, indicating a high level of freshness. The direct quote from Danai Antoniou is unique to this report, suggesting potential originality. The source, CNBC, is reputable, and the mention of Gradient Labs adds credibility. However, the report lacks specific factual anchors, such as names, institutions, and dates, which reduces the score and flags the content as potentially synthetic. Therefore, while the overall assessment is a pass, the medium confidence rating reflects some uncertainties regarding the freshness and originality of the content.