University students share practical strategies, from leveraging digital discounts to smarter accommodation choices, to manage rising costs and thrive during their studies.

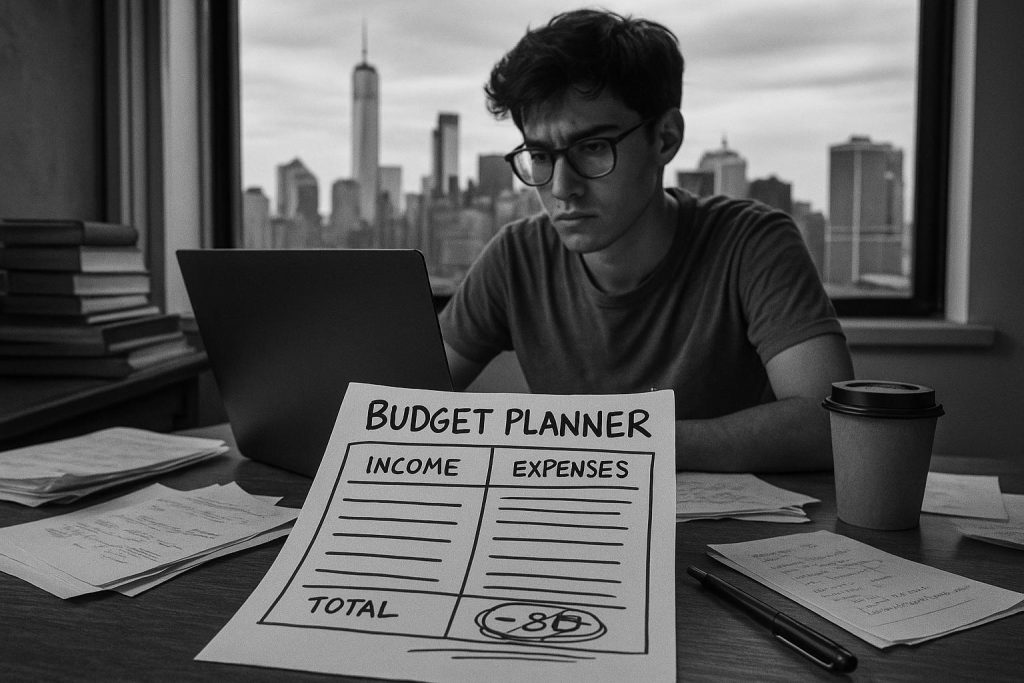

University students face a challenging financial landscape, requiring practical strategies to stretch limited budgets effectively. Current and recent students have shared their best money-saving tips, offering valuable insights into navigating university expenses with greater ease.

A fundamental recommendation is to sign up for student discount platforms such as UNiDAYS and Student Beans. These free digital services verify student status to unlock discounts ranging from 10% to 20% across hundreds of brands, covering everything from fashion to technology and travel. According to platform data, students can access significant savings by simply registering with a valid academic email. By consulting these sites regularly before making purchases, students can reduce costs substantially.

Using cash instead of electronic payments during nights out is another practical budgeting tool. One student pointed out that bringing a fixed amount of cash helps prevent overspending, especially when contactless payments make it so effortless to lose track. This method also reduces theft risks by allowing phones to stay safely tucked away. It is worth noting that some university towns still have many cash-friendly venues, making this approach viable.

Investing in good-quality items, albeit initially more expensive, is often more economical in the long run. Repeatedly replacing cheap bedding or kitchenware can accumulate considerable costs, whereas durable products last beyond university, offering better value and sustainability. This approach also aligns with an increasing awareness among students of environmental considerations.

Maximising the value of university-provided opportunities is key. Attending lectures is essential, but students should also engage in societies aligned with their interests—be it sports, languages, or theatre. These activities are usually heavily subsidised and offer excellent skill-building opportunities. Moreover, many universities provide grants for travel and internships abroad, which can be life-enhancing experiences funded through the institution. Checking out these options early in the academic year ensures students don’t miss out due to ignorance.

Premeditating spending on nights out by researching venue menus and offers online helps set clear budgets and avoid unexpected expenses. This level of planning can contribute significantly to financial discipline in social settings.

Housing remains a major expense for students. Sharing a room in the first year has proven to be a highly effective saving strategy for some, halving rent costs and providing social benefits like companionship. However, it is not suitable for everyone and depends on personal preferences and circumstances. Given the broader trend of rising rent costs in university towns and cities, exploring shared accommodation can be essential for financial sustainability.

Beyond these direct tips, broader financial advice includes creating detailed budgets, cooking at home, buying used textbooks, and using free campus events as entertainment—all ways to minimise outgoings while enhancing student life. Such holistic financial management is critical amid rising living costs and rent hikes seen across many urban areas.

Finally, while instalment plans for rent payments exist, financial experts warn these can introduce costly fees that increase the overall rent. Alternatives such as negotiating directly with landlords, seeking roommates, or increasing income through part-time work may be less burdensome ways to manage housing expenses.

Students aiming to optimise their finances should therefore combine digital discount tools, prudent budgeting, quality purchasing decisions, active use of university resources, and thoughtful accommodation choices. These strategies collectively can help mitigate the significant financial pressures faced during university years, enabling students to focus more on their studies and personal growth.

📌 Reference Map:

- Paragraph 1 – [1], [5]

- Paragraph 2 – [1], [2], [3]

- Paragraph 3 – [1], [5]

- Paragraph 4 – [1], [5]

- Paragraph 5 – [1], [5]

- Paragraph 6 – [1], [5]

- Paragraph 7 – [1], [4], [6], [7]

Source: Noah Wire Services

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative was published on 8 September 2025, making it current. However, similar content has appeared in the past, such as an article from 28 August 2021 titled ‘Never buy a book you can borrow: students’ best money-saving tips’ ([theguardian.com](https://www.theguardian.com/money/2021/aug/28/students-money-saving-tips-university-best-buy?utm_source=openai)). This suggests that while the specific examples are new, the overall theme is recycled.

Quotes check

Score:

7

Notes:

The quotes from students are unique to this narrative. However, similar advice has been offered in previous articles, indicating that while the quotes are original, the ideas are not.

Source reliability

Score:

10

Notes:

The narrative originates from The Guardian, a reputable UK news organisation, lending it high credibility.

Plausability check

Score:

9

Notes:

The advice provided is practical and aligns with common money-saving strategies for students. The inclusion of specific student experiences adds authenticity. However, the repetition of similar content in previous years suggests a lack of new insights.

Overall assessment

Verdict (FAIL, OPEN, PASS): OPEN

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

While the narrative is current and originates from a reputable source, the content largely recycles advice from previous years without offering significant new insights. The inclusion of unique student quotes adds some originality, but the overall freshness is compromised by the repetition of similar themes.